STAY INFORMED

Logistics and Supply Chain Updates during the war in the Ukraine

Latest updates: Ocean Freight

Ocean operations

- At least 3 sea mine reports drifting in the Black Sea area. One mine was reported northeast of Constanta in Romania, the second one off Igneada close to the Bulgarian border and the third one at Istanbul Strait. National authorities are trying to detect and neutralize any other mines. However, masters should still be very cautious, avoid any floating objects and the crew should not stay on the forward area of the vessel.

- Inbalance of container availability foreseeable. Most likely many boxes will be accumulating in the Russian and Belarussian ports as carriers still refuse to call those due to sanctions.

- The fifth sanctions package is to further restrict trade with Russia and will also affect shipping. European ports will be closed to Russian ships, except for food, aid and oil deliveries. However, according to the German Verband Deutscher Reeder, this poses the risk that our ships could be tied up in Russian ports. Additionally, the package will include an import ban on coal, wood and vodka.

Rail operations

- After the sudden decision at the end of March to stop all passenger and freight traffic between Finland and Russia, freight trains were allowed to run again after a few days. Now, however, the Finnish railroad company VR has decided to shut down freight traffic in a controlled manner in the coming months.

- DHL accepts bookings on the north corridor, however there isn’t a real demand for it.

Market trends

- The pallet industry will also be affected by the newest package of sanctions. According to European suppliers of the HPE industry, 90% of the nails needed for pallets and 25% of the wood assortment have been imported from Russia, Belarus and Ukraine so far. The shortage of pallets in Germany is becoming more and more foreseeable, because, for example, German production machinery is designed only for a certain quality of steel, which, among other things, can be found only in the Russian nails, and the machines cannot be converted.

Ocean Operations

- Many vessels and seafarers are still stuck inside ports or anchors in Ukraine and while food and water in cities is becoming scarce, supplies on ships are also decreasing. The International Maritime Organization is demanding to establish a “blue corridor” in the Black Sea through which the ships will safely return to the open sea. However, in practice it will still be dangerous, as there are rumors about mines in the approaches to ports.

- Besides Cosco, the turkish shipper line Arkas is still operating in Russia.

Rail Operations

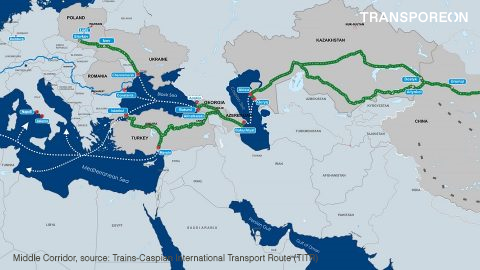

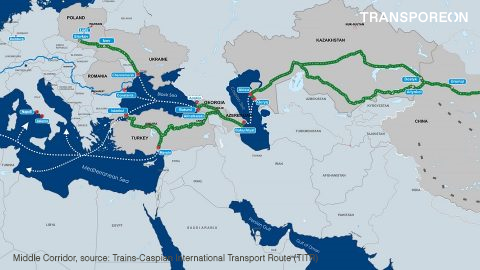

- According to Middle Corridor Logistics 3-5 per cent of the total capacity of the northern routes accounts on the middle corridor now, expecting to increase even further as this route is seen as one of the alternatives for the New Silk Road. However this route isn't ready yet for the increasing demand from the northern side. The route has several seas in between which justifies the relatively high tariffs, but there are substantial investments to be done to meet the increasing demand.

- The swiss company Hupac reports that intermodal trains to and from Russia are running as usual. Nevertheless, they report lower transport volumes and a significant drop in the exchange with Russia via the silk route. Hupac will try their best to keep the operations running.

Operations

- Ukrainian ports (Black Sea and Azov Sea) remain closed.

- Navigation in the north-western part of the Black Sea continues to be blocked by the Russian Navy.

- COSCO remains the only major shipper line which is still operating in Russia.

- Maersk still carries out occasional ship calls in Russia to collect remaining containers, discussions are ongoing if this could also be done by rail.

- MSC is still delivering foodstuff, medical equipment and humanitarian cargo to Russia.

- Significant delays of all boxes bound for Russia via the Netherlands, Belgium and Germany, as they are now subject to individual check from local customs.

- More pressure on supply chain sea and air.

- Seaborne trade with Russia has dropped by 58% as of 18 of March since the invasion of Ukraine began.

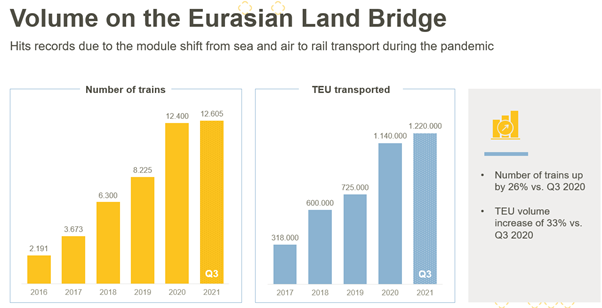

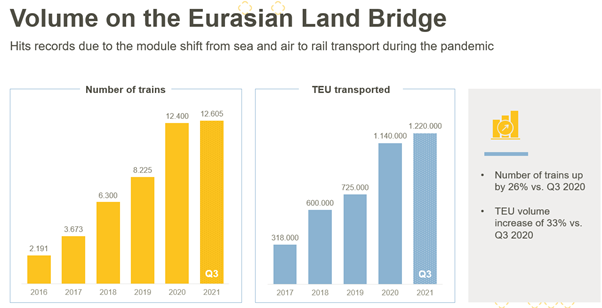

Eurasian land bridge

- Many shippers switch from rail to sea transport.

- Transportation via Northern route through the Russian Railways is difficult.

- Strategic volume moves from traditional belt road (via Russia) to middle and southern route is possible.

- Rumania, Bulgaria are the options.

Issues on the Land Bridge:

- Capacity limitations.

- Interruptions and trains delays.

- Payments issues to/from Russian party.

- Borders congestions.

- Transportation through Azerbaijan, Georgia, Turkey, Uzbekistan is not so smoothly as through Kazakhstan, since there are border issues.

- Maersk vessel calls will be made at the Russian ports of St. Petersburg and Kaliningrad Baltic), Novorossoviisk (Black Sea), and Vladivostok/Vostochny (Sea of Japan) to retrieve 50,000+ empty containers.

- Maersk plans to deliver all containers destined to Russian ports booked prior to hostilities but without time commitments.

- Limited feeder service is available from North Europe to Baltic ports, with Unifeeder confirming 3 weekly sailings but subject to change. Goods being transported are medicines, food, and humanitarian products.

- Dutch customs has lifted the general stop on cargo bound for Russia.

- Delays are to be expected, as containers are checked individually for sanctioned goods. Almost all carriers still refuse bookings to Russia, except for humanitarian cargo (food, medical supply).

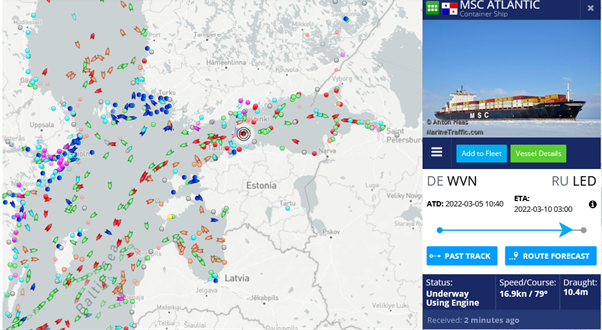

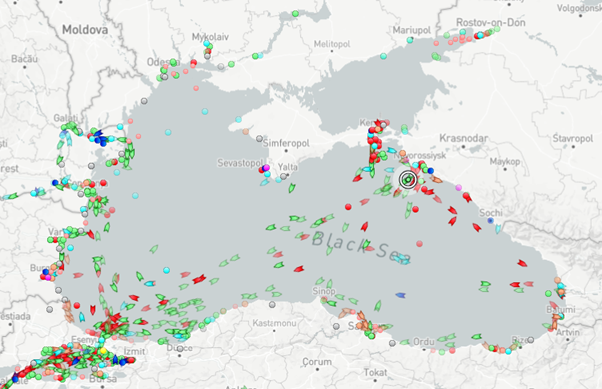

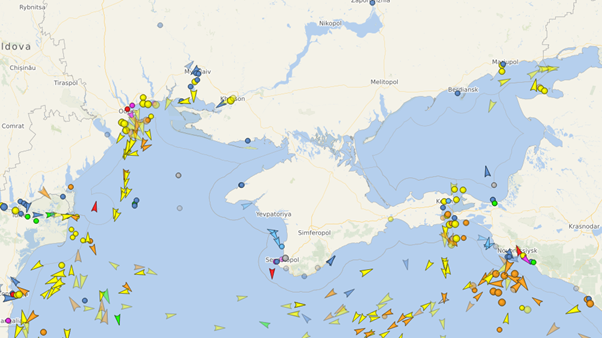

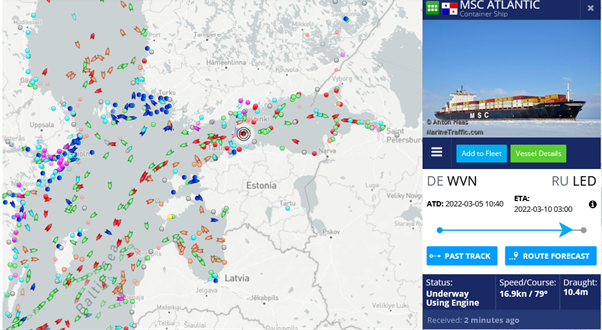

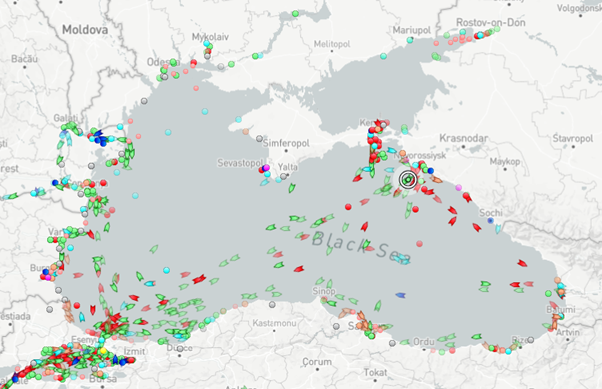

Source: marinetraffic.com

- Fuel costs continue to increase and are now 30% up from pre-war levels.

- In line with carriers statements, ship operations toward Russia (picture from marinetraffic.com) are continuing with only food & medical supplies are accepted as cargo. This would potentially allow for a speedy resumption of bookings in case of a diplomatic resolution of the conflict.

-

Cargo in transit on the European Land Bridge is also still being delivered, but with the current booking stop it is questionable to what extend operations will be continued in the upcoming weeks.

-

According to the Kiel trade Indicator global trade was more than 5% down in February, with only China being able to slightly increase its exports.

Source: Kiel Institue for the World Economy

- It is not increasingly transparent that Asia to Europe container volumes are negatively affected by the Ukraine conflict. Shipping demand is reduced, due to a stop of Asian exports to Ukraine and Russia, so far transshipped via North West Europe and Turkey. This is, at least for the time being outweighing the increase in demand as cargo is moved from (intercontinental) rail to sea.

- If the conflict is not resolved within the upcoming weeks, selected trade lanes are set to see a demand boom as importers across the world look for alternative sources for goods so far procured from Russia and Ukraine (with Turkey and South America coming to mind)). Russian and Ukrainian Trade profiles are helpful for a first assessment:

https://oec.world/en/profile/country/ukr

https://oec.world/en/profile/country/rus

Operations

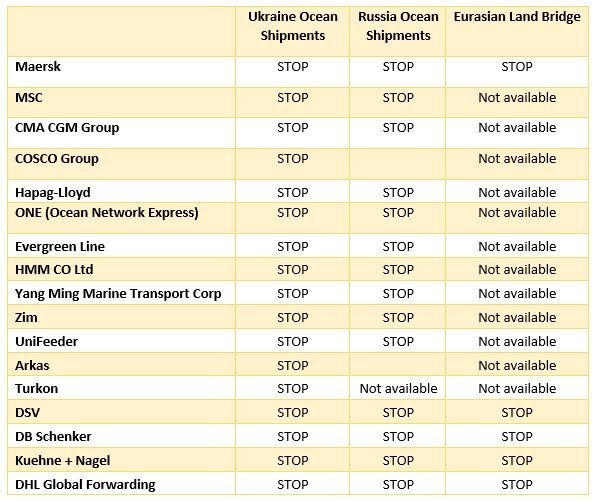

- ZIM announced a booking stop for Russian transports.

- UK closed ports for Russian ships.

- Number of damaged ships due to Ukraine war increases.

- Cruise liners are adapting their routes and skip usual stops in Russia.

Market

- Spot market influenced by Ukraine war and sanctions against Russia, increase mainly for pacific transactions

- On the 10th and 11th of march an extraordinary council session of the International Maritime Organization (IMO) will take place to discuss the impacts on the maritime economy

- Not only are supply chains affected by the war, it could also lead to pallet shortages. Ukraine and Russia are important suppliers of pallet wood and pallets. So far it is unclear how big the impact will be, but an increasing shortage is foreseeable, which will result in rising pallet prices.

- DSV and Unifeeder announced a booking stop for Russian transports.

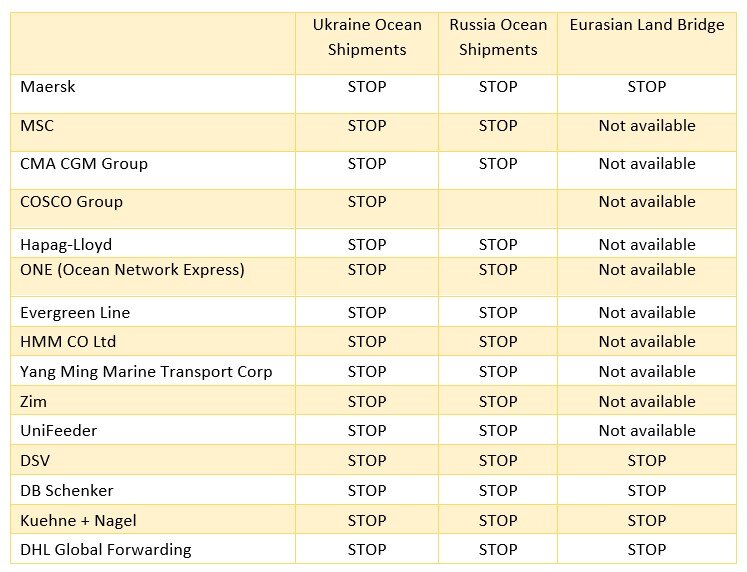

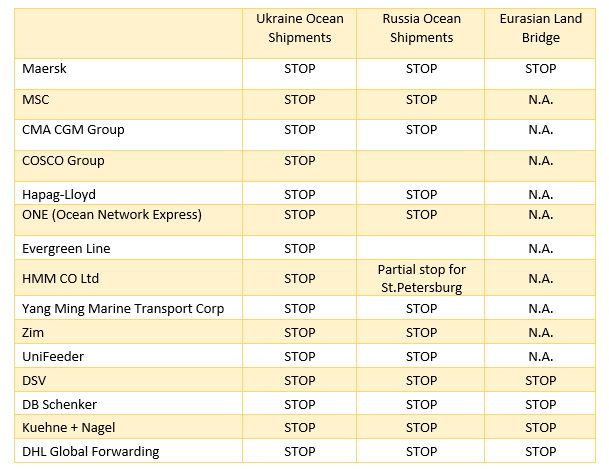

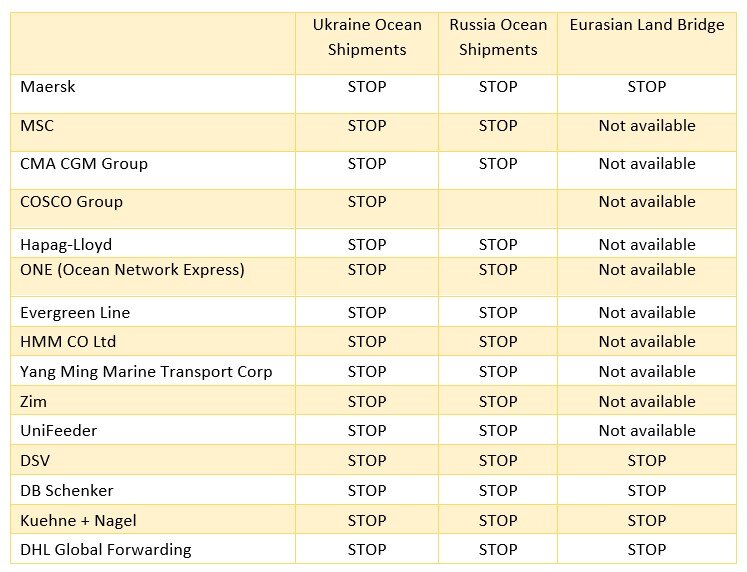

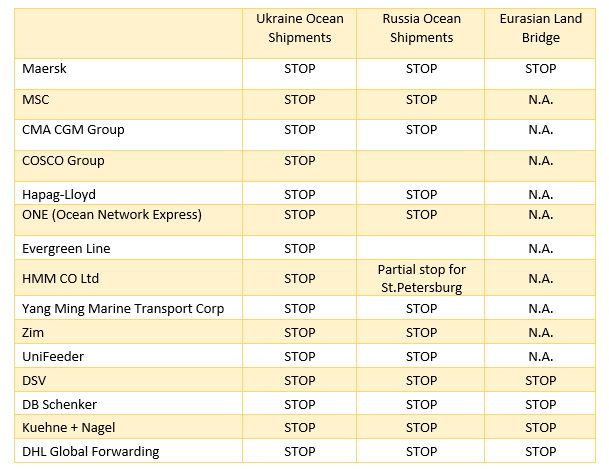

- First European forwards are stopping their bookings toward the Eurosian Land Bridge.

- Spot rates from China to Europe are currently decreasing.

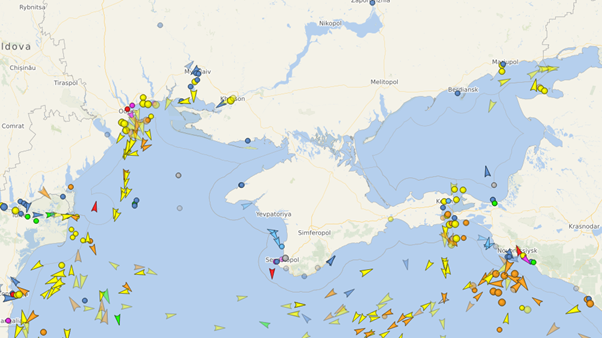

Picture from marinetraffic.com, green ships are cargo vessels.

Operations

It is now easier to state that COSCO, ZIM (still calling Noworossijsk at the black sea yesterday) Unifeeder and forwarder DSV have not (yet) announced a booking stop.

Meanwhile cargo destinated for Russia and Ukraine is now pilling up in multiple ports, especially Constanza, Istanbul, Hamburg and Rotterdam. Shipper should be prepared for delays or rising detention & demurrage charges at these ports.

Eurasian Land Bridge

We expect that European Forwarders will stop bookings toward the Eurasian Land Bridge, which by large crosses toward Russia, impacting many European and Chinese producers. Customers report that Dachser and DHL have already suspended bookings and shippers should prepare themselves for a general booking stop. A southern variant of the land bridge that crosses the Caspian sea by ferry and then goes through Turkey exist, but can offer neither the capacity nor the transit time currently provided by the northern route.

If volumes currently using the container rail would be added to the Asia – Europe ocean freight demand this would mean an 5 to 8% increase in a still congested trade.

Freight rates

Asia – Europe ocean freight rates have already been pushed so far above carriers cost levels that the impact of rising fuel costs and increased Suez canal transit fees should be barely noticeable. On North-South trades, which are more cost driven the aggregated fuel cost increase of the last 3 months could however result in a 5 to 14% increase of total costs.

MSC has now also stopped bookings for most goods toward Russia.

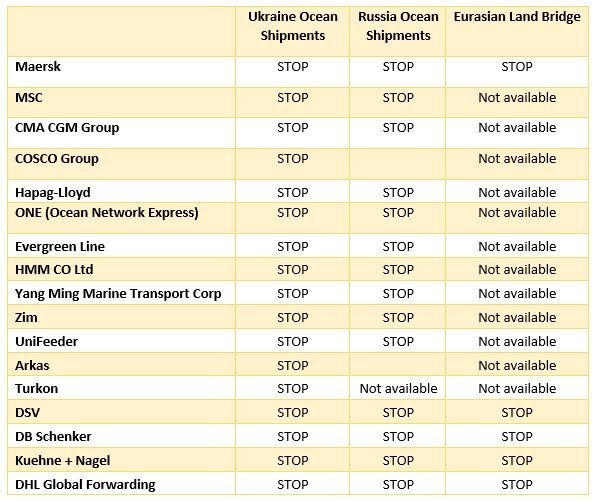

The trend of carriers stopping bookings to and from Russia has continued.

This is (with the Dutch exception mentioned below) not mandated by Russian or Western authorities, but either motivated by a desire to protect the shipping lines public image or an assessment that, with sanctions incoming, this business is currently “not worth the trouble”.

As such, it is to be expected that additional carriers will follow and suspend bookings, but also that carriers who are more risk friendly or cater to a different audience such as MSC or COSCO pursue a different strategy.

Individual positionings far:

- Hapag Lloyd suspended bookings to and from Russia.

H-L is operating the NBS and PEX services to St. Petersburg and Kaliningrad respectively.

H-L has also advised that containers in transit to Noworossijsk will be dropped of at Istanbul: this likely refers to the BMX service on which H-L is a vessel provider

- Maersk suspended bookings to and from Russia.

Maersk operates the only two long distance services calling Noworossijsk, but is not operating any ships on Baltic services.

APM Terminals is operating two of the major three terminals at St. Petersburg, further disruptions here should be expected

- ONE suspended bookings to and from Russia.

ONE is operating the KRX service to Vladivostok, but is not operating any ships on Baltic services.

- MSC has announced to continue serving Russia for cargo compliant with sanctions and advised customers to expect delays from increased controls

- CMA-CGM / Containerships and Unifeeder (owned by DP World), who provide a major share of capacity toward St. Petersburg, have not yet commented on plans with regards to Russia

- Forwarders DHL, Fedex and UPS have stopped bookings to and from Russia

- Dutch customs is currently stopping all shipments toward Russia

Unfortunate new developments from today require another update:

- Dutch customs are now confirmed to be blocking all export containers with destination Russia https://www.joc.com/maritime-news/dutch-customs-block-russian-boxes-one-cuts-bookings_20220228.html

- ONE is also no longer accepting bookings for Russia.

- Russian railways has been included in EU and US sanction list. This could severely disrupt, if not stop Eurasian land bridge traffic. Clarification on this is expected, as this move would hurt European interests far more than Russiahttps://www.railfreight.com/policy/2022/02/28/no-business-with-russian-railways-say-the-us-and-eu/

Impact on ports & services:

- No change in operational servicing: Ukraine closed for the foreseeable future. Noworossijsk and Baltic ports still open

- Cargo intended for Odessa is to be dropped off mostly at Constanta, although carriers have also announced some drop offs at Istanbul, Piraeus and Tunis

- Cosco vessel Joseph Schulte (9400 TEU) currently stuck at Odessa

- Turkey has denied reports of a closure of the Bosporus strait for Russian military shipping. Closure for civilian shipping is highly unlikely

- Despite warnings for the black sea in general, carriers seem committed to continue services to Bulgaria and Romania

- Hapag Lloyd announced a temporary stop of bookings to Russia last week. Operations toward Russia are continuing. No current update available, but clarification (either operations stop or booking resumption) this week expected

- Uncertainty is obviously high among carriers of how to deal with operations toward Russia, with inconclusive messaging.

Some reports of booking stops toward Russia also for other carriers, although Maersk, MSC and Zim have confirmed that they intend to continue their services for the time being. It should be reiterated that so far no suspension of operations are known and no announced / discussed sanctions would force a halt of services toward Russia. Some carriers might still stop services out of concern for their public images, but especially smaller feeder carriers providing the mainstay of capacity will likely continue for economic reasons.

Please let us know if you are currently experiencing booking stops toward Russia.

Impact on Eurasian Land Bridge:

- Operation of trains are continuing.

- Flexport has suspended bookings for land bridge cargo.

- DSV and Maersk have confirmed they will continue to operate this service for the time being.

Russian flagged, owned and operated ships:

- First bans and arrests against Russian tankers are reported from France and the UK.

- While this is a major issue for tanker and bulk shipping, the potential impact on container shipping is marginal (<1% of global capacity).

- UNCTAD Russia maritime profile.

- UNCTAD Ukraine maritime profile.

Russian & Ukrainian seafarers:

Both Russia and the Ukraine are among the top nations contributing to the global marine workforce.

Especially among technical personnel (engineers) and on Intra-European services they are numerous.

Due to COVID related restrictions seafaring jobs are increasingly unattractive and a shortage of qualified personnel is looming. Conscription of Ukrainian and possible travel & money transfer restrictions against Russian mariners will speed up this development.

Impact on ports:

- The port of Odessa and all other Ukrainian ports have been closed and will likely remain closed as long as fighting continues.

- Waiting and in transit ships are steaming away from the area.

-

Ports have been repeatedly hit by Russian strikes against infrastructure. If container terminals are impacted and to which extend is not clear.

-

Russia has closed the Sea of Azov for commercial shipping.

-

The port of Noworossijsk and Russian Baltic ports are functioning as normal.

-

Russian and Ukrainian Black Sea areas have been designated a war risk area (https://www.lmalloyds.com/lma/jointwar)

Impact on Eurasian Land Bridge:

- Flows are continuing along the Eurasian Land Bridge (https://www.railfreight.com/railfreight/2022/02/24/live-blog-russia-ukraine-war-impact-on-rail-freight/)

- The relatively small portion of trains normally passing through Ukraine (especially: cargo to Hungary) has been rerouted via Belarus.

- Delays are to be expected for in transit and upcoming shipments due to additional traffic on Belarussian tracks by this reroutings and military logistic.

Sanctions:

- Sanctions so far announced focus on finance, oil & gas industry and technology exports to Russia.

- Shutting down maritime, road or rail traffic seems not to be intended although they might suffer indirectly due more complicated payment processes.

In addition to yesterday’s market radar update we would like to provide you with a quick overview on the impact of the Russia – Ukraine confrontation on global container shipping and risks for further disruptions shippers should monitor an prepare for.

Direct impact on ocean container networks could occur as either:

- Ships avoiding the black sea region due to fear of being targeted in a direct military confrontation. This has so far not happened. Unlike airlines who have stopped services toward Ukraine, cargos ships are still heading toward the region.

- Ships skipping port calls at Russian Baltic, Black Sea or Far Eastern ports, as liners fear to be targeted by sanctions against Russia. This is possible, but not very likely, as sanctions will probably focus on the oil and gas industry, which is far more vital for Russia. Having a land border toward both China and multiple European countries, Russia is less depended on or important for container shipping than other economies of a similar size.

While this can be disruptive to regional trades, global container shipping as a whole should not be significantly affected, as none of the major trade lanes is connected to the ports or regions in question. A potential strike at US Pacific ports would be significantly more critical – Monitor if region is important for your business.

Impact on the Eurasian Land Bridge container rail connection:

While Russia can be expected to refrain from a permanent blockade out of consideration for Chinese economic interests a temporary halt of transports is to be expected in case of a military confrontation and a possibility as an element of political power play – Monitor & prepare for worst case, if land Bridge is important for your business.

Cyber-attacks intentionally or accidentally disruption port or carrier systems:

Russia has been linked to cyber attacks in the past and they might occur as part of economic warfare by either side (https://www.independent.co.uk/news/uk/politics/russia-ukraine-cyber-attack-ben-wallace-b2019836.html?fr=operanews). The shipping industry in its current congested state is even more vulnerable to such disruptions than other industries, so this could easily be the most severe consequence. (Prof. Karamperidis excellent presentation on this subject is available in our benchmark viewer at https://mia.timsolutions.net/) – Having contingency planning for cyber-attacks against own and carriers systems is general best practice.

Risking fuel prices as a result of an oil price hike:

Fuel prices have already increased by 20% over the last one and a half months and are forecasted to rise further in case of lasting sanctions against Russia or a military conflict. This will have a significant impact especially on backhaul and intra-regional rates. Main haul rates are currently already far above carriers cost due to high demand and the impact of further fuel costs increases would be hardly noticed.

Impact of rising energy costs on the global economy and thereby shipping demand:

Too complex to forecast impact in detail. Sanctions announced so far seem to be tailored to minimize impact on western economies, but in case of further escalation consequences could be massive.

We will keep you updated in case of significant changes in the situation or our assessment.

Ocean operations

- At least 3 sea mine reports drifting in the Black Sea area. One mine was reported northeast of Constanta in Romania, the second one off Igneada close to the Bulgarian border and the third one at Istanbul Strait. National authorities are trying to detect and neutralize any other mines. However, masters should still be very cautious, avoid any floating objects and the crew should not stay on the forward area of the vessel.

- Inbalance of container availability foreseeable. Most likely many boxes will be accumulating in the Russian and Belarussian ports as carriers still refuse to call those due to sanctions.

- The fifth sanctions package is to further restrict trade with Russia and will also affect shipping. European ports will be closed to Russian ships, except for food, aid and oil deliveries. However, according to the German Verband Deutscher Reeder, this poses the risk that our ships could be tied up in Russian ports. Additionally, the package will include an import ban on coal, wood and vodka.

Rail operations

- After the sudden decision at the end of March to stop all passenger and freight traffic between Finland and Russia, freight trains were allowed to run again after a few days. Now, however, the Finnish railroad company VR has decided to shut down freight traffic in a controlled manner in the coming months.

- DHL accepts bookings on the north corridor, however there isn’t a real demand for it.

Market trends

- The pallet industry will also be affected by the newest package of sanctions. According to European suppliers of the HPE industry, 90% of the nails needed for pallets and 25% of the wood assortment have been imported from Russia, Belarus and Ukraine so far. The shortage of pallets in Germany is becoming more and more foreseeable, because, for example, German production machinery is designed only for a certain quality of steel, which, among other things, can be found only in the Russian nails, and the machines cannot be converted.

Ocean Operations

- Many vessels and seafarers are still stuck inside ports or anchors in Ukraine and while food and water in cities is becoming scarce, supplies on ships are also decreasing. The International Maritime Organization is demanding to establish a “blue corridor” in the Black Sea through which the ships will safely return to the open sea. However, in practice it will still be dangerous, as there are rumors about mines in the approaches to ports.

- Besides Cosco, the turkish shipper line Arkas is still operating in Russia.

Rail Operations

- According to Middle Corridor Logistics 3-5 per cent of the total capacity of the northern routes accounts on the middle corridor now, expecting to increase even further as this route is seen as one of the alternatives for the New Silk Road. However this route isn't ready yet for the increasing demand from the northern side. The route has several seas in between which justifies the relatively high tariffs, but there are substantial investments to be done to meet the increasing demand.

- The swiss company Hupac reports that intermodal trains to and from Russia are running as usual. Nevertheless, they report lower transport volumes and a significant drop in the exchange with Russia via the silk route. Hupac will try their best to keep the operations running.

Operations

- Ukrainian ports (Black Sea and Azov Sea) remain closed.

- Navigation in the north-western part of the Black Sea continues to be blocked by the Russian Navy.

- COSCO remains the only major shipper line which is still operating in Russia.

- Maersk still carries out occasional ship calls in Russia to collect remaining containers, discussions are ongoing if this could also be done by rail.

- MSC is still delivering foodstuff, medical equipment and humanitarian cargo to Russia.

- Significant delays of all boxes bound for Russia via the Netherlands, Belgium and Germany, as they are now subject to individual check from local customs.

- More pressure on supply chain sea and air.

- Seaborne trade with Russia has dropped by 58% as of 18 of March since the invasion of Ukraine began.

Eurasian land bridge

- Many shippers switch from rail to sea transport.

- Transportation via Northern route through the Russian Railways is difficult.

- Strategic volume moves from traditional belt road (via Russia) to middle and southern route is possible.

- Rumania, Bulgaria are the options.

Issues on the Land Bridge:

- Capacity limitations.

- Interruptions and trains delays.

- Payments issues to/from Russian party.

- Borders congestions.

- Transportation through Azerbaijan, Georgia, Turkey, Uzbekistan is not so smoothly as through Kazakhstan, since there are border issues.

- Maersk vessel calls will be made at the Russian ports of St. Petersburg and Kaliningrad Baltic), Novorossoviisk (Black Sea), and Vladivostok/Vostochny (Sea of Japan) to retrieve 50,000+ empty containers.

- Maersk plans to deliver all containers destined to Russian ports booked prior to hostilities but without time commitments.

- Limited feeder service is available from North Europe to Baltic ports, with Unifeeder confirming 3 weekly sailings but subject to change. Goods being transported are medicines, food, and humanitarian products.

- Dutch customs has lifted the general stop on cargo bound for Russia.

- Delays are to be expected, as containers are checked individually for sanctioned goods. Almost all carriers still refuse bookings to Russia, except for humanitarian cargo (food, medical supply).

Source: marinetraffic.com

- Fuel costs continue to increase and are now 30% up from pre-war levels.

- In line with carriers statements, ship operations toward Russia (picture from marinetraffic.com) are continuing with only food & medical supplies are accepted as cargo. This would potentially allow for a speedy resumption of bookings in case of a diplomatic resolution of the conflict.

-

Cargo in transit on the European Land Bridge is also still being delivered, but with the current booking stop it is questionable to what extend operations will be continued in the upcoming weeks.

-

According to the Kiel trade Indicator global trade was more than 5% down in February, with only China being able to slightly increase its exports.

Source: Kiel Institue for the World Economy

- It is not increasingly transparent that Asia to Europe container volumes are negatively affected by the Ukraine conflict. Shipping demand is reduced, due to a stop of Asian exports to Ukraine and Russia, so far transshipped via North West Europe and Turkey. This is, at least for the time being outweighing the increase in demand as cargo is moved from (intercontinental) rail to sea.

- If the conflict is not resolved within the upcoming weeks, selected trade lanes are set to see a demand boom as importers across the world look for alternative sources for goods so far procured from Russia and Ukraine (with Turkey and South America coming to mind)). Russian and Ukrainian Trade profiles are helpful for a first assessment:

https://oec.world/en/profile/country/ukr

https://oec.world/en/profile/country/rus

Operations

- ZIM announced a booking stop for Russian transports.

- UK closed ports for Russian ships.

- Number of damaged ships due to Ukraine war increases.

- Cruise liners are adapting their routes and skip usual stops in Russia.

Market

- Spot market influenced by Ukraine war and sanctions against Russia, increase mainly for pacific transactions

- On the 10th and 11th of march an extraordinary council session of the International Maritime Organization (IMO) will take place to discuss the impacts on the maritime economy

- Not only are supply chains affected by the war, it could also lead to pallet shortages. Ukraine and Russia are important suppliers of pallet wood and pallets. So far it is unclear how big the impact will be, but an increasing shortage is foreseeable, which will result in rising pallet prices.

- DSV and Unifeeder announced a booking stop for Russian transports.

- First European forwards are stopping their bookings toward the Eurosian Land Bridge.

- Spot rates from China to Europe are currently decreasing.

Picture from marinetraffic.com, green ships are cargo vessels.

Operations

It is now easier to state that COSCO, ZIM (still calling Noworossijsk at the black sea yesterday) Unifeeder and forwarder DSV have not (yet) announced a booking stop.

Meanwhile cargo destinated for Russia and Ukraine is now pilling up in multiple ports, especially Constanza, Istanbul, Hamburg and Rotterdam. Shipper should be prepared for delays or rising detention & demurrage charges at these ports.

Eurasian Land Bridge

We expect that European Forwarders will stop bookings toward the Eurasian Land Bridge, which by large crosses toward Russia, impacting many European and Chinese producers. Customers report that Dachser and DHL have already suspended bookings and shippers should prepare themselves for a general booking stop. A southern variant of the land bridge that crosses the Caspian sea by ferry and then goes through Turkey exist, but can offer neither the capacity nor the transit time currently provided by the northern route.

If volumes currently using the container rail would be added to the Asia – Europe ocean freight demand this would mean an 5 to 8% increase in a still congested trade.

Freight rates

Asia – Europe ocean freight rates have already been pushed so far above carriers cost levels that the impact of rising fuel costs and increased Suez canal transit fees should be barely noticeable. On North-South trades, which are more cost driven the aggregated fuel cost increase of the last 3 months could however result in a 5 to 14% increase of total costs.

MSC has now also stopped bookings for most goods toward Russia.

The trend of carriers stopping bookings to and from Russia has continued.

This is (with the Dutch exception mentioned below) not mandated by Russian or Western authorities, but either motivated by a desire to protect the shipping lines public image or an assessment that, with sanctions incoming, this business is currently “not worth the trouble”.

As such, it is to be expected that additional carriers will follow and suspend bookings, but also that carriers who are more risk friendly or cater to a different audience such as MSC or COSCO pursue a different strategy.

Individual positionings far:

- Hapag Lloyd suspended bookings to and from Russia.

H-L is operating the NBS and PEX services to St. Petersburg and Kaliningrad respectively.

H-L has also advised that containers in transit to Noworossijsk will be dropped of at Istanbul: this likely refers to the BMX service on which H-L is a vessel provider

- Maersk suspended bookings to and from Russia.

Maersk operates the only two long distance services calling Noworossijsk, but is not operating any ships on Baltic services.

APM Terminals is operating two of the major three terminals at St. Petersburg, further disruptions here should be expected

- ONE suspended bookings to and from Russia.

ONE is operating the KRX service to Vladivostok, but is not operating any ships on Baltic services.

- MSC has announced to continue serving Russia for cargo compliant with sanctions and advised customers to expect delays from increased controls

- CMA-CGM / Containerships and Unifeeder (owned by DP World), who provide a major share of capacity toward St. Petersburg, have not yet commented on plans with regards to Russia

- Forwarders DHL, Fedex and UPS have stopped bookings to and from Russia

- Dutch customs is currently stopping all shipments toward Russia

Unfortunate new developments from today require another update:

- Dutch customs are now confirmed to be blocking all export containers with destination Russia https://www.joc.com/maritime-news/dutch-customs-block-russian-boxes-one-cuts-bookings_20220228.html

- ONE is also no longer accepting bookings for Russia.

- Russian railways has been included in EU and US sanction list. This could severely disrupt, if not stop Eurasian land bridge traffic. Clarification on this is expected, as this move would hurt European interests far more than Russiahttps://www.railfreight.com/policy/2022/02/28/no-business-with-russian-railways-say-the-us-and-eu/

Impact on ports & services:

- No change in operational servicing: Ukraine closed for the foreseeable future. Noworossijsk and Baltic ports still open

- Cargo intended for Odessa is to be dropped off mostly at Constanta, although carriers have also announced some drop offs at Istanbul, Piraeus and Tunis

- Cosco vessel Joseph Schulte (9400 TEU) currently stuck at Odessa

- Turkey has denied reports of a closure of the Bosporus strait for Russian military shipping. Closure for civilian shipping is highly unlikely

- Despite warnings for the black sea in general, carriers seem committed to continue services to Bulgaria and Romania

- Hapag Lloyd announced a temporary stop of bookings to Russia last week. Operations toward Russia are continuing. No current update available, but clarification (either operations stop or booking resumption) this week expected

- Uncertainty is obviously high among carriers of how to deal with operations toward Russia, with inconclusive messaging.

Some reports of booking stops toward Russia also for other carriers, although Maersk, MSC and Zim have confirmed that they intend to continue their services for the time being. It should be reiterated that so far no suspension of operations are known and no announced / discussed sanctions would force a halt of services toward Russia. Some carriers might still stop services out of concern for their public images, but especially smaller feeder carriers providing the mainstay of capacity will likely continue for economic reasons.

Please let us know if you are currently experiencing booking stops toward Russia.

Impact on Eurasian Land Bridge:

- Operation of trains are continuing.

- Flexport has suspended bookings for land bridge cargo.

- DSV and Maersk have confirmed they will continue to operate this service for the time being.

Russian flagged, owned and operated ships:

- First bans and arrests against Russian tankers are reported from France and the UK.

- While this is a major issue for tanker and bulk shipping, the potential impact on container shipping is marginal (<1% of global capacity).

- UNCTAD Russia maritime profile.

- UNCTAD Ukraine maritime profile.

Russian & Ukrainian seafarers:

Both Russia and the Ukraine are among the top nations contributing to the global marine workforce.

Especially among technical personnel (engineers) and on Intra-European services they are numerous.

Due to COVID related restrictions seafaring jobs are increasingly unattractive and a shortage of qualified personnel is looming. Conscription of Ukrainian and possible travel & money transfer restrictions against Russian mariners will speed up this development.

Impact on ports:

- The port of Odessa and all other Ukrainian ports have been closed and will likely remain closed as long as fighting continues.

- Waiting and in transit ships are steaming away from the area.

-

Ports have been repeatedly hit by Russian strikes against infrastructure. If container terminals are impacted and to which extend is not clear.

-

Russia has closed the Sea of Azov for commercial shipping.

-

The port of Noworossijsk and Russian Baltic ports are functioning as normal.

-

Russian and Ukrainian Black Sea areas have been designated a war risk area (https://www.lmalloyds.com/lma/jointwar)

Impact on Eurasian Land Bridge:

- Flows are continuing along the Eurasian Land Bridge (https://www.railfreight.com/railfreight/2022/02/24/live-blog-russia-ukraine-war-impact-on-rail-freight/)

- The relatively small portion of trains normally passing through Ukraine (especially: cargo to Hungary) has been rerouted via Belarus.

- Delays are to be expected for in transit and upcoming shipments due to additional traffic on Belarussian tracks by this reroutings and military logistic.

Sanctions:

- Sanctions so far announced focus on finance, oil & gas industry and technology exports to Russia.

- Shutting down maritime, road or rail traffic seems not to be intended although they might suffer indirectly due more complicated payment processes.

In addition to yesterday’s market radar update we would like to provide you with a quick overview on the impact of the Russia – Ukraine confrontation on global container shipping and risks for further disruptions shippers should monitor an prepare for.

Direct impact on ocean container networks could occur as either:

- Ships avoiding the black sea region due to fear of being targeted in a direct military confrontation. This has so far not happened. Unlike airlines who have stopped services toward Ukraine, cargos ships are still heading toward the region.

- Ships skipping port calls at Russian Baltic, Black Sea or Far Eastern ports, as liners fear to be targeted by sanctions against Russia. This is possible, but not very likely, as sanctions will probably focus on the oil and gas industry, which is far more vital for Russia. Having a land border toward both China and multiple European countries, Russia is less depended on or important for container shipping than other economies of a similar size.

While this can be disruptive to regional trades, global container shipping as a whole should not be significantly affected, as none of the major trade lanes is connected to the ports or regions in question. A potential strike at US Pacific ports would be significantly more critical – Monitor if region is important for your business.

Impact on the Eurasian Land Bridge container rail connection:

While Russia can be expected to refrain from a permanent blockade out of consideration for Chinese economic interests a temporary halt of transports is to be expected in case of a military confrontation and a possibility as an element of political power play – Monitor & prepare for worst case, if land Bridge is important for your business.

Cyber-attacks intentionally or accidentally disruption port or carrier systems:

Russia has been linked to cyber attacks in the past and they might occur as part of economic warfare by either side (https://www.independent.co.uk/news/uk/politics/russia-ukraine-cyber-attack-ben-wallace-b2019836.html?fr=operanews). The shipping industry in its current congested state is even more vulnerable to such disruptions than other industries, so this could easily be the most severe consequence. (Prof. Karamperidis excellent presentation on this subject is available in our benchmark viewer at https://mia.timsolutions.net/) – Having contingency planning for cyber-attacks against own and carriers systems is general best practice.

Risking fuel prices as a result of an oil price hike:

Fuel prices have already increased by 20% over the last one and a half months and are forecasted to rise further in case of lasting sanctions against Russia or a military conflict. This will have a significant impact especially on backhaul and intra-regional rates. Main haul rates are currently already far above carriers cost due to high demand and the impact of further fuel costs increases would be hardly noticed.

Impact of rising energy costs on the global economy and thereby shipping demand:

Too complex to forecast impact in detail. Sanctions announced so far seem to be tailored to minimize impact on western economies, but in case of further escalation consequences could be massive.

We will keep you updated in case of significant changes in the situation or our assessment.

Latest updates: Air Freight

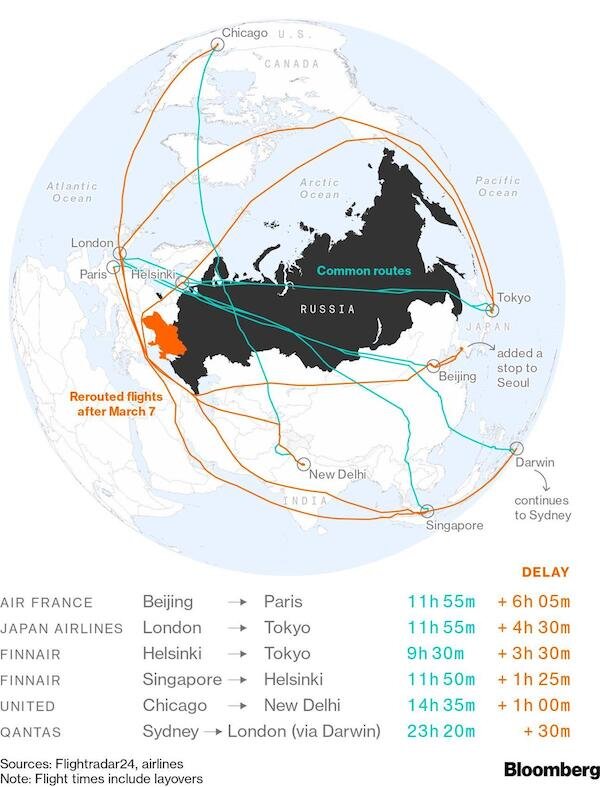

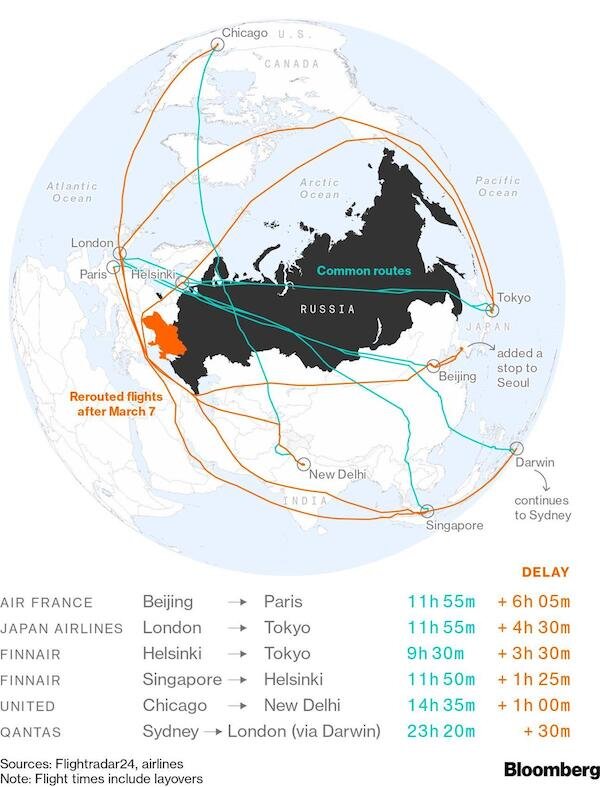

Source: AJOT / Bloomberg

- Russian government preparing law to regulate leased aircraft: Aircraft-wise decision on handover or not, leasing rates to be changed to Russian Rubel, activation of Russian aircraft insurances to substitute lost contracts. Rumors indicate that Russian airlines are not aligned with this approach as they fear long-term effect in working with non-Russian banks, lessors, insurances, and other entities.

- Isle of Man & Bermuda Civil Aviation Authorities removed Russian aircraft from registration as authorities cannot guarantee airworthiness as result of sanctions. This means further cargo capacity withdrawal on global scale, not only in banned flight zones.

- More Asian carriers suspended Far East - Europe flights as result of route deviations and high jet fuel prices. Connections to Russia limited as increasing fear of unavailability of fuel & equipment in Russia.

- First carriers announce summer season capacity reduction as high fuel cost burden.

- Preighters suffering under fuel cost bills while revenue per flight is limited – mid-term engagement to be reviewed.

- Covid impacting Asia and the world: PAX flights to PVG suspended for 6 weeks; Shenzhen also under hard lockdown; Hong Kong won’t resume international travel.

- Passenger airlines to cancel passenger flights as result of bans, loosing valuable cargo capacities.

- Vessels’ waiting queue for ocean port berths became longer; shifts to air cargo foreseen. Also, port closures being expanded due to Chinese zero Covid strategy/lockdowns.

- Trucking in China stressed, affecting air & ocean supply chain.

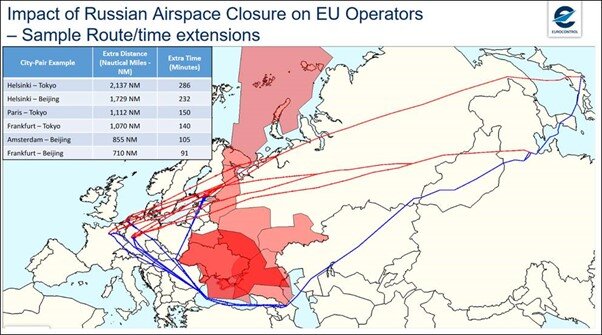

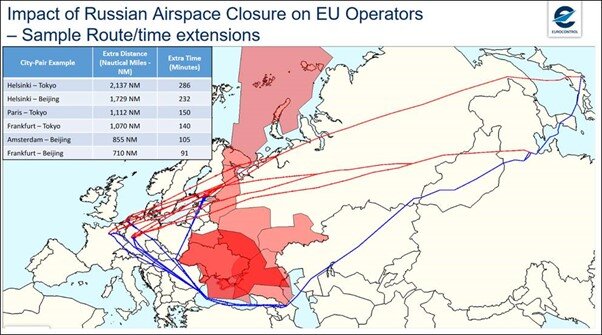

Source: EUROCONTROL

- Russian airlines have already suspended or will suspend most international flights as result of sanctions. High risk that assets could be confiscated. Only few destinations are still on schedule.

- Aeroflot’s try to repatriate Russian people from European countries dismissed last weekend.

- Market comments estimate a -10% reduction of available cargo capacity due to longer flights (route deviations & higher fuel weight). Some carriers (temporarily) suspended direct flights between Far East and Central Europe. Please note the diagram in this e-mail to assess potential deviation impacts.

- Increasing crude oil & jet fuel prices evolve risk of further fuel surcharges despite of “fixed” fuel clauses.

- Providers still apply contract agreements to a high degree. Some forwarders ask for “over-the-thumb” surcharges, covering increased fuel prices, deviations, and corresponding war risk costs. Some Community partners report on surcharges abt. 20 - 80 cents per kg. But many shippers still on normal levels to a high degree. Advice is not to accept such surcharge proposal but to re-negotiate on a more detailed level.

- Spot became more volatile. China, Taiwan and Japan mainly suffering on rate increases.

- Tenders Q1.2022 / early Q2.2022: Current instable situation is challenge for forwarders and carriers to approach multi-month competitive rates & services. Several shippers and forwarders approached postponement of due new tenders by few weeks until the situation is clearer. Driving factors are reliable flight schedules of carriers, and cost situation anticipations that avoiding peak price consideration.

Provider

- Logistics service providers (LSP) suspended services in Ukraine.

- Many LSPs suspended transportation and stopped booking & cargo acceptance for Russia and war risk zone.

- Buffer areas expected to be stressed by cargo soon.

- Carriers started to claim war risk surcharges – to be forwarded to shippers despite of often high margins for carriers & air freight forwarders.

- Airports are affected differently depending on customers structure & network lanes.

Shippers

- Many shippers affected as inbound goods were not received or outbound goods cannot be shipped.

- Shipper facilities & plants partly closed and reduced operations in war risk and connected zones.

- First shippers were approached by their providers for surcharges with an “over-thethumb” approach.

- Shippers can rely on booked space, but short-term spot rates are partly hiking on some routes as capacities are only limited.

- Missing previous block spaces with Russian carriers force many shippers to alternatives; need for capacities of high volumes.

Market

- North American and European countries introduced airspace bans for Russian carriers.

- Russia responded in same way by banning carriers from more than 30 countries.

- Airspace flight bans are driving factor for latest supply chain disruptions.

- Route deviations result in less available capacity & elevated cost levels.

- Non-availability of Russian capacities with immediate effect on supply chains, performances, and costs.

- Eurasian land bridge is still open but carrying increasing risk for delayed war & sanction impacts.

Airspace and Aircraft Overview

Significant share of Russian aircraft belonging to non-Russian owners, putting them in conflict.

Asset owner dilemma

When tensions between Russia and Ukraine became more concrete already during February, insurance companies forced asset owners and airlines to avoid the war risk zone. Many aircraft were parked outside the risk area. As result of sanctions against Russia, aircraft lessors were forced to terminate contracts with Russian carriers. Nearly half of Russian’s civil aviation fleet is non-Russian owned. Half of the affected assets are owned by European companies.

Challenge is removing the aircraft from current employment and bringing the assets back to neutral airspace & airports – if Russian airlines release the aircraft.

European service providers for Russian carriers suspended services to avoid any risk to break sanctions.

Asset owners to bring removed aircraft under new deployment. Non-European and non-North American carriers can benefit by allowance of Russian airspace usage, connecting Europe resp. North America with Far East.

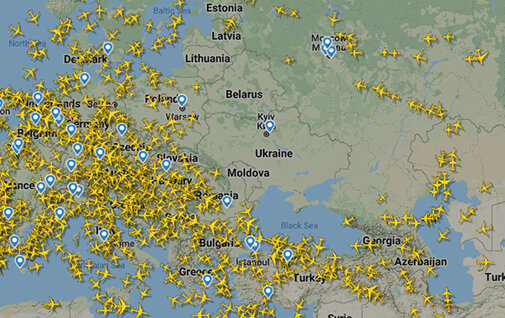

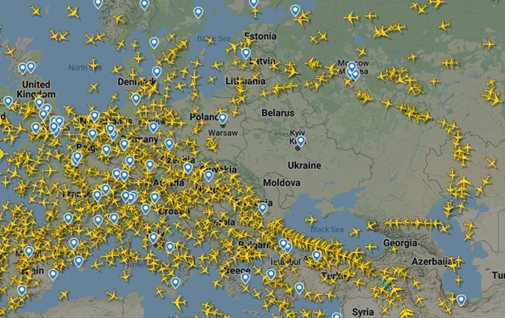

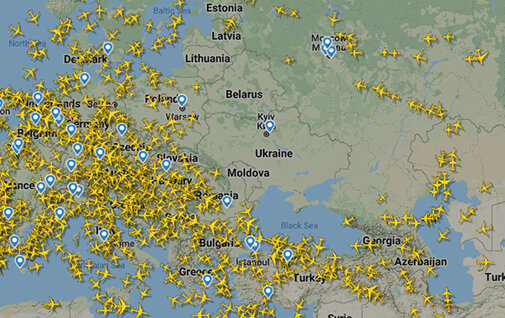

Source picture: Flightradar24.com as of February 28, 2022, 07:58 (GMT+1).

Airspace & connectivity

No major changes: The airspace of Ukraine and neighboring regions continues to be blocked for civilian aviation resulting in longer flight times and re-routing.

Logistics operations

- European countries implemented airspace bans on Russian airlines. Russia responded in the same way by banning European airlines from Russian airspace.

- As consequence of sanctions, Russian carrier Airbridgecargo (ABC) loses access to its freight hubs Frankfurt and Liege (Belgium). ABC’s parent company Volga-Dnepr Group looking for alternatives to move air cargo in compliance with sanctions.

- Asian airlines not affected by airspace bans yet.

- US airport Anchorage (Alaska) in focus as possible routing alternative to Asia when Russian airspace is/stays closed.

- Largest cargo freighter Antonov AN-225 “Mriya” destroyed at Ukraine Antonov base. Rest of Antonov’s freighter fleet is not in war zone.

- Many freight forwarders / logistics companies suspended operations in Ukraine.

- Riparian countries try to ensure functioning border crossing with Ukraine.

People & other information

- Russian government plans to evacuate Russian citizens from European countries as result of airspace bans.

- Refugees from Ukraine arrive in neighbor countries.

- Unconfirmed rumors are spreading that Belarus could actively intervene in the war in support of Russia.

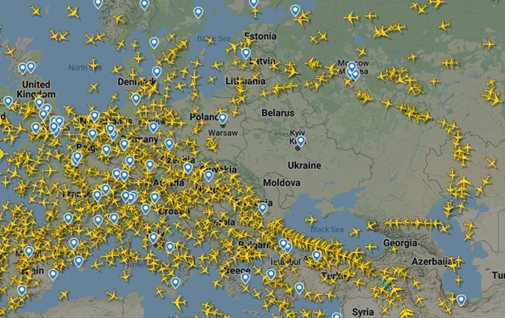

Source picture: Flightradar24.com as of February 25, 09:53 (GMT+1)

As the situation in the Ukraine escalates, we want to provide you with the related impact for air freight.

Air space & Connectivity:

The air space of the Ukraine is already blocked for civilian aviation. Also parts of Belarus’ and Moldova’s airspace are affected and partly closed for civil aviation (see picture below). Therefore no aircraft can fly over or land in these regions. In addition, as all sea ports of Ukraine are currently closed, this further impacts supply chains. Rerouting of flights as well as mode shifts to trucking are one possibility to move cargo, but they result in longer lead times, increased costs for carriers as well as planning insecurity. First shippers suffer from “Force Majeure” as they struggle to export goods from Ukraine. Not all geographics in the Ukraine will be possible to supply depending on how the situation develops.

Airports in the Ukraine:

Russia has attacked several airports in Ukraine, among it the airport Hostomol (GML). Hostomol is a freight hub and basis for cargo airline Antonov Airlines. Further airports expected to follow, decreasing available capacity.

Jet Fuel & further costs:

Oil prices and jet fuel prices jumped up. Furthermore, route deviations will result in increasing costs for carriers. Surcharges for shippers are likely.

Sanctions against Russia:

Sanctions by the EU targeting five areas, including energy sector and transport sector. Among others, sanctions shall cancel flow of spare parts and other technical equipment from EU to Russian Airlines. Sanction package to be official on Friday afternoon.

Risk: As answer to EU sanctions, Russia could cancel flyover rights for EU airlines, de facto closing Russian air space for EU airlines. This would massively impact Europe-Asian air corridor. Switching cargo from European to Asian airlines could then be an alternative for shippers, as Russia is unlikely to close its airspace for Asian Airlines as well.

Great Britain has banned Russian airlines from entering its airspace or landing.

We follow the situation very closely and will keep you updated.

Source: AJOT / Bloomberg

- Russian government preparing law to regulate leased aircraft: Aircraft-wise decision on handover or not, leasing rates to be changed to Russian Rubel, activation of Russian aircraft insurances to substitute lost contracts. Rumors indicate that Russian airlines are not aligned with this approach as they fear long-term effect in working with non-Russian banks, lessors, insurances, and other entities.

- Isle of Man & Bermuda Civil Aviation Authorities removed Russian aircraft from registration as authorities cannot guarantee airworthiness as result of sanctions. This means further cargo capacity withdrawal on global scale, not only in banned flight zones.

- More Asian carriers suspended Far East - Europe flights as result of route deviations and high jet fuel prices. Connections to Russia limited as increasing fear of unavailability of fuel & equipment in Russia.

- First carriers announce summer season capacity reduction as high fuel cost burden.

- Preighters suffering under fuel cost bills while revenue per flight is limited – mid-term engagement to be reviewed.

- Covid impacting Asia and the world: PAX flights to PVG suspended for 6 weeks; Shenzhen also under hard lockdown; Hong Kong won’t resume international travel.

- Passenger airlines to cancel passenger flights as result of bans, loosing valuable cargo capacities.

- Vessels’ waiting queue for ocean port berths became longer; shifts to air cargo foreseen. Also, port closures being expanded due to Chinese zero Covid strategy/lockdowns.

- Trucking in China stressed, affecting air & ocean supply chain.

Source: EUROCONTROL

- Russian airlines have already suspended or will suspend most international flights as result of sanctions. High risk that assets could be confiscated. Only few destinations are still on schedule.

- Aeroflot’s try to repatriate Russian people from European countries dismissed last weekend.

- Market comments estimate a -10% reduction of available cargo capacity due to longer flights (route deviations & higher fuel weight). Some carriers (temporarily) suspended direct flights between Far East and Central Europe. Please note the diagram in this e-mail to assess potential deviation impacts.

- Increasing crude oil & jet fuel prices evolve risk of further fuel surcharges despite of “fixed” fuel clauses.

- Providers still apply contract agreements to a high degree. Some forwarders ask for “over-the-thumb” surcharges, covering increased fuel prices, deviations, and corresponding war risk costs. Some Community partners report on surcharges abt. 20 - 80 cents per kg. But many shippers still on normal levels to a high degree. Advice is not to accept such surcharge proposal but to re-negotiate on a more detailed level.

- Spot became more volatile. China, Taiwan and Japan mainly suffering on rate increases.

- Tenders Q1.2022 / early Q2.2022: Current instable situation is challenge for forwarders and carriers to approach multi-month competitive rates & services. Several shippers and forwarders approached postponement of due new tenders by few weeks until the situation is clearer. Driving factors are reliable flight schedules of carriers, and cost situation anticipations that avoiding peak price consideration.

Provider

- Logistics service providers (LSP) suspended services in Ukraine.

- Many LSPs suspended transportation and stopped booking & cargo acceptance for Russia and war risk zone.

- Buffer areas expected to be stressed by cargo soon.

- Carriers started to claim war risk surcharges – to be forwarded to shippers despite of often high margins for carriers & air freight forwarders.

- Airports are affected differently depending on customers structure & network lanes.

Shippers

- Many shippers affected as inbound goods were not received or outbound goods cannot be shipped.

- Shipper facilities & plants partly closed and reduced operations in war risk and connected zones.

- First shippers were approached by their providers for surcharges with an “over-thethumb” approach.

- Shippers can rely on booked space, but short-term spot rates are partly hiking on some routes as capacities are only limited.

- Missing previous block spaces with Russian carriers force many shippers to alternatives; need for capacities of high volumes.

Market

- North American and European countries introduced airspace bans for Russian carriers.

- Russia responded in same way by banning carriers from more than 30 countries.

- Airspace flight bans are driving factor for latest supply chain disruptions.

- Route deviations result in less available capacity & elevated cost levels.

- Non-availability of Russian capacities with immediate effect on supply chains, performances, and costs.

- Eurasian land bridge is still open but carrying increasing risk for delayed war & sanction impacts.

Airspace and Aircraft Overview

Significant share of Russian aircraft belonging to non-Russian owners, putting them in conflict.

Asset owner dilemma

When tensions between Russia and Ukraine became more concrete already during February, insurance companies forced asset owners and airlines to avoid the war risk zone. Many aircraft were parked outside the risk area. As result of sanctions against Russia, aircraft lessors were forced to terminate contracts with Russian carriers. Nearly half of Russian’s civil aviation fleet is non-Russian owned. Half of the affected assets are owned by European companies.

Challenge is removing the aircraft from current employment and bringing the assets back to neutral airspace & airports – if Russian airlines release the aircraft.

European service providers for Russian carriers suspended services to avoid any risk to break sanctions.

Asset owners to bring removed aircraft under new deployment. Non-European and non-North American carriers can benefit by allowance of Russian airspace usage, connecting Europe resp. North America with Far East.

Source picture: Flightradar24.com as of February 28, 2022, 07:58 (GMT+1).

Airspace & connectivity

No major changes: The airspace of Ukraine and neighboring regions continues to be blocked for civilian aviation resulting in longer flight times and re-routing.

Logistics operations

- European countries implemented airspace bans on Russian airlines. Russia responded in the same way by banning European airlines from Russian airspace.

- As consequence of sanctions, Russian carrier Airbridgecargo (ABC) loses access to its freight hubs Frankfurt and Liege (Belgium). ABC’s parent company Volga-Dnepr Group looking for alternatives to move air cargo in compliance with sanctions.

- Asian airlines not affected by airspace bans yet.

- US airport Anchorage (Alaska) in focus as possible routing alternative to Asia when Russian airspace is/stays closed.

- Largest cargo freighter Antonov AN-225 “Mriya” destroyed at Ukraine Antonov base. Rest of Antonov’s freighter fleet is not in war zone.

- Many freight forwarders / logistics companies suspended operations in Ukraine.

- Riparian countries try to ensure functioning border crossing with Ukraine.

People & other information

- Russian government plans to evacuate Russian citizens from European countries as result of airspace bans.

- Refugees from Ukraine arrive in neighbor countries.

- Unconfirmed rumors are spreading that Belarus could actively intervene in the war in support of Russia.

Source picture: Flightradar24.com as of February 25, 09:53 (GMT+1)

As the situation in the Ukraine escalates, we want to provide you with the related impact for air freight.

Air space & Connectivity:

The air space of the Ukraine is already blocked for civilian aviation. Also parts of Belarus’ and Moldova’s airspace are affected and partly closed for civil aviation (see picture below). Therefore no aircraft can fly over or land in these regions. In addition, as all sea ports of Ukraine are currently closed, this further impacts supply chains. Rerouting of flights as well as mode shifts to trucking are one possibility to move cargo, but they result in longer lead times, increased costs for carriers as well as planning insecurity. First shippers suffer from “Force Majeure” as they struggle to export goods from Ukraine. Not all geographics in the Ukraine will be possible to supply depending on how the situation develops.

Airports in the Ukraine:

Russia has attacked several airports in Ukraine, among it the airport Hostomol (GML). Hostomol is a freight hub and basis for cargo airline Antonov Airlines. Further airports expected to follow, decreasing available capacity.

Jet Fuel & further costs:

Oil prices and jet fuel prices jumped up. Furthermore, route deviations will result in increasing costs for carriers. Surcharges for shippers are likely.

Sanctions against Russia:

Sanctions by the EU targeting five areas, including energy sector and transport sector. Among others, sanctions shall cancel flow of spare parts and other technical equipment from EU to Russian Airlines. Sanction package to be official on Friday afternoon.

Risk: As answer to EU sanctions, Russia could cancel flyover rights for EU airlines, de facto closing Russian air space for EU airlines. This would massively impact Europe-Asian air corridor. Switching cargo from European to Asian airlines could then be an alternative for shippers, as Russia is unlikely to close its airspace for Asian Airlines as well.

Great Britain has banned Russian airlines from entering its airspace or landing.

We follow the situation very closely and will keep you updated.

Latest updates: Road Freight

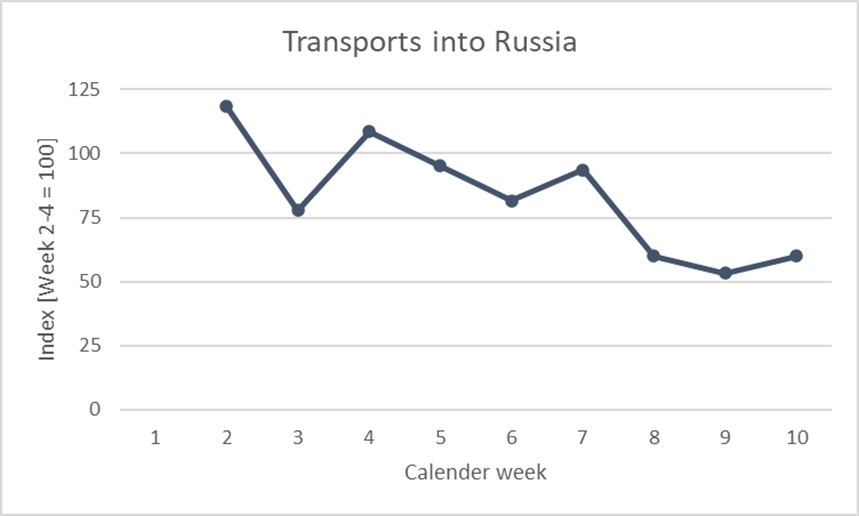

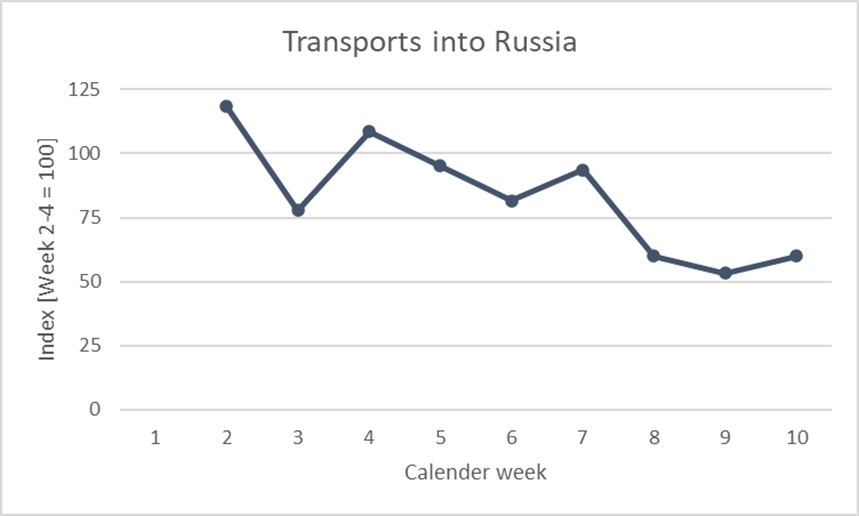

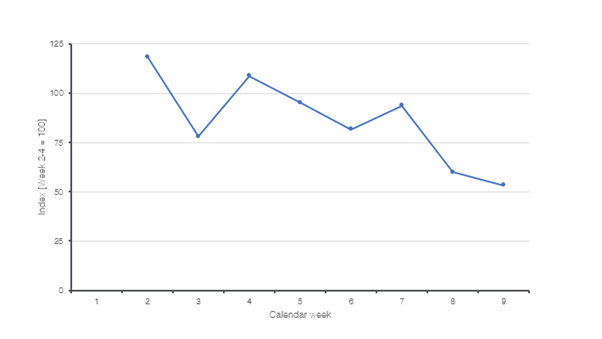

- Number of transports into Russia stabilized in week 10 at almost half of the pre-war level.

- Contracted prices into Russia decreased in comparison to extreme heights in week 8 and 9, but still elevated around 1.5 of the prices paid in week 3 (normal level).

- Many shippers without transports into Russia for >3 weeks indicating and confirming stopped or paused business in this direction.

- We are closely monitoring the capacity situation especially the carrier behavior (rejections and offers) which should change if Ukraine drivers in an influencing number are leaving.

- Week 10 and 11 showed a worsening overall situation but in line with the historic seasonal behavior. So far, no direct impact in data visible, we will closely monitor and keep you up to date on this development.

Constantly changing situation leads to high risks which causes turbulences on transport rates

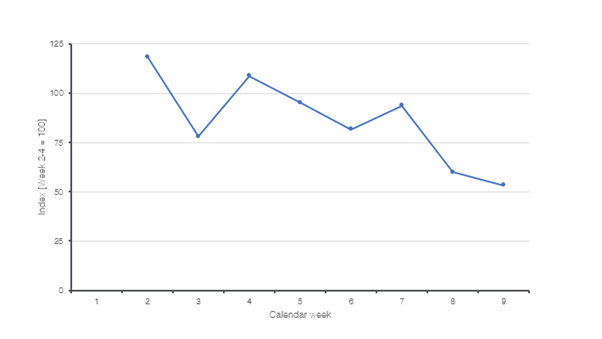

Executed Transports into Russiart rates.

Number of transports halved in week 9 compared to week 2-4 average.

Prices & Rejections

Severe price increases:

- Contracted rates into Russia increased heavily: 1.5 to 2.5 of the prices of week 3 to be paid in week 8 and 9.

- Contracted rates leaving Russia also increased but considerably lower as the other direction.

- Spot rates from Poland into Russia in week 9 YoY +106% outbound Russia +79% YoY.

- Rejections showed turbulent situations in past weeks but without clear picture.

Carrier & Shipper Reactions

- Stop of business and unclear and constantly changing situation.

- Dynamic situations lead to many uncertainties related to export controls and sanctions.

- Many companies from various industries stopped their Russian business (domestic, import & export).

- Some European carriers officially announced to not serve Russia as destination anymore.

- Driver shortage due to return of Ukrainian drivers - Currently not visible.

Developments visible in Transporeon Insights.

Due to the devaluation of the Russian Ruble, contract and spot rates for domestic transports in Russia are in steep decline.

Spot and contract rates for transports from and to Russia are also affected. Spot rates on the lane Russia to Germany have increased 51% since last week. Spot rates from Poland to Russia are now 35% more expensive than last week.

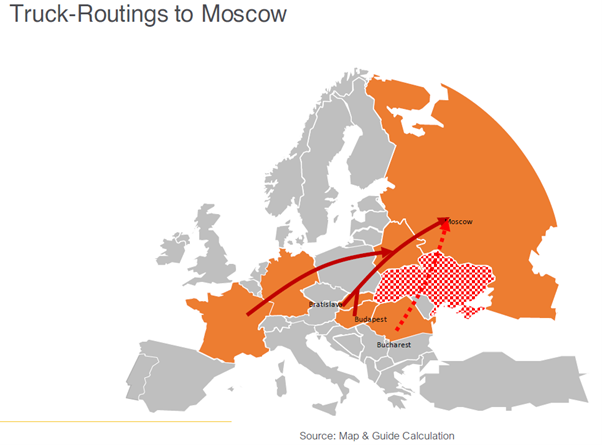

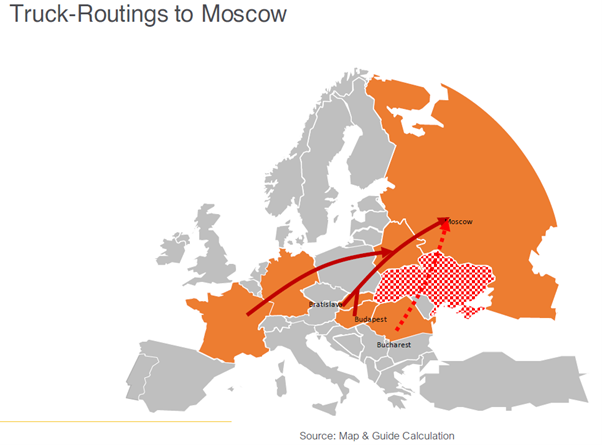

The escalation of the situation in the Ukraine is also affecting European transports especially the ones touching the Ukraine and/or going into Russia. Please find attached first information concerning possible routes and truck alternatives as well in the following some comments on price developments we monitored until yesterday evening. Most transport routings are not touching the Ukraine (especially from Western Europe) as they are majorly entering Russia via Poland and Belarus.

When analyzing contracted shipments from the Transporeon platform from DE, PL and FR going into Russia, we see beginning with week 4 – week over week increases on identical lanes. For week 8 until yesterday evening these increases are resulting in 1.5 up to 2.5 times the prices of week 3 (which showed normal contracted prices). It is a fair assumption that this is also the case for lanes out of other European countries where we currently not see enough transports to verify the situation.

- Number of transports into Russia stabilized in week 10 at almost half of the pre-war level.

- Contracted prices into Russia decreased in comparison to extreme heights in week 8 and 9, but still elevated around 1.5 of the prices paid in week 3 (normal level).

- Many shippers without transports into Russia for >3 weeks indicating and confirming stopped or paused business in this direction.

- We are closely monitoring the capacity situation especially the carrier behavior (rejections and offers) which should change if Ukraine drivers in an influencing number are leaving.

- Week 10 and 11 showed a worsening overall situation but in line with the historic seasonal behavior. So far, no direct impact in data visible, we will closely monitor and keep you up to date on this development.

Constantly changing situation leads to high risks which causes turbulences on transport rates

Executed Transports into Russiart rates.

Number of transports halved in week 9 compared to week 2-4 average.

Prices & Rejections

Severe price increases:

- Contracted rates into Russia increased heavily: 1.5 to 2.5 of the prices of week 3 to be paid in week 8 and 9.

- Contracted rates leaving Russia also increased but considerably lower as the other direction.

- Spot rates from Poland into Russia in week 9 YoY +106% outbound Russia +79% YoY.

- Rejections showed turbulent situations in past weeks but without clear picture.

Carrier & Shipper Reactions

- Stop of business and unclear and constantly changing situation.

- Dynamic situations lead to many uncertainties related to export controls and sanctions.

- Many companies from various industries stopped their Russian business (domestic, import & export).

- Some European carriers officially announced to not serve Russia as destination anymore.

- Driver shortage due to return of Ukrainian drivers - Currently not visible.

Developments visible in Transporeon Insights.

Due to the devaluation of the Russian Ruble, contract and spot rates for domestic transports in Russia are in steep decline.

Spot and contract rates for transports from and to Russia are also affected. Spot rates on the lane Russia to Germany have increased 51% since last week. Spot rates from Poland to Russia are now 35% more expensive than last week.

The escalation of the situation in the Ukraine is also affecting European transports especially the ones touching the Ukraine and/or going into Russia. Please find attached first information concerning possible routes and truck alternatives as well in the following some comments on price developments we monitored until yesterday evening. Most transport routings are not touching the Ukraine (especially from Western Europe) as they are majorly entering Russia via Poland and Belarus.

When analyzing contracted shipments from the Transporeon platform from DE, PL and FR going into Russia, we see beginning with week 4 – week over week increases on identical lanes. For week 8 until yesterday evening these increases are resulting in 1.5 up to 2.5 times the prices of week 3 (which showed normal contracted prices). It is a fair assumption that this is also the case for lanes out of other European countries where we currently not see enough transports to verify the situation.

Get the news delivered to your mail

Fill out the form below to sign up for notifications whenever we release a new update on the situation in Ukraine.

PRODUCTS

Explore our digital freight solutions

Together our products work in harmony to increase transport efficiency along the full lifecycle of freight activities.