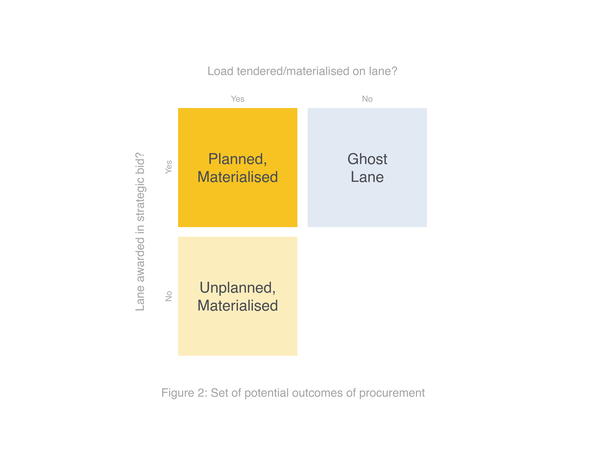

In addition, of the ghost lanes that were procured the previous year, the next highest category was also ghost lanes the previous year – meaning we have recurring ghost lanes year to year. The rest of the ghost lanes had very few loads materialise on them throughout the previous year.

We also find that lanes that typically have less outbound demand – and as a result have higher spot prices – are more likely to be ghost lanes. This suggest shippers are trying to lock in contract prices for lanes that they know will have high spot prices otherwise.

Finally we find that ghost lanes appear more often during soft market conditions rather than tight markets. As noted by previous research, firms tend to create budget slack – here by creating more contracted lanes – during these more favourable economic, soft market conditions as protection for when things go poorly in the future.

Question 3: Is the coverage procurement approach reducing cost escalations for shippers as intended, or would it be better to remove potential ghost lanes from the procurement event?

To answer our third research question, we model the price differential between contract and spot prices on lanes that are likely to become ghost lanes, as identified by our previous model. While shippers’ intentions in procuring contracts on these lanes is to establish lower contract prices than the spot prices they would otherwise be exposed to, we find that in fact, these contracts are priced higher than their lane-specific spot prices. For example, new lane contracts are between 13% and 40% higher than spot prices, and lanes that are previously procured but turn out to be ghost lanes are between 7% and 11% higher than spot prices.

This suggests that the uncertainty in volume demand for carriers on these lanes is being accounted for when they submit bid prices for contracts. Not only are shippers not seeing the cost savings they expect by establishing contracts on these lanes, they’re actually overpaying by quite a lot.