Building on the first and second episodes, in our third and final masterclass on science-based transportation, we explore how to strategically use spot market data to inform pricing decisions. I discuss ongoing research on dynamic pricing in the full truckload (FTL) segment and demonstrate how an alternative contractual form – namely, index-based pricing – can lower costs for shippers, increase freight acceptance from carriers, and boost carrier revenue, when implemented on the appropriate network segments.

Data analysis, pricing strategies and technology solutions to leverage the spot market

08/07/2023 | 8 min

Why a different pricing mechanism?

The standard, long-term, fixed-price contract is the most common contract form used for FTL. But despite its prominence, it is not the best suited option in many contexts. During fluctuating market conditions, a price set during an RFQ (request for quote) can become obsolete before it ever goes live. Shippers run the risk of carriers no longer honoring contracts at their pre-set prices. As the contract ages, the price becomes increasingly out of date. For high-volume, consistent, anchor legs on carrier networks, aging prices may not result in decreased performance due to economies of scope. But for lanes which are less attractive, due to inability to find backhauls or variable demand patterns, the performance is definitely impacted.

One could be short-term contract with more frequent, manual price updates. Also called continuous procurement, shippers can run mini bids on lanes for which the contract price is no longer competitive and performance issues are arising. Another option is tiered volume contracts where a base level of shipments is set to one price, and volume above this is set at a premium to counter the added operational costs, which carriers incur from serving unplanned demand.

Finally, dynamic pricing can be a smart solution. One version of dynamic pricing is the reliance on the spot market. But we can also think about designing a contract where the price is automatically updated, based on a representation of current market dynamics – a market index (like Market Insights).

One question may remain: why go through the trouble of establishing new pricing mechanisms within the contract, rather than using the spot market directly? The short answer is that there are demonstrated relational benefits to working with a contracted shipper and carrier: working with a carrier who knows your facilities reduces potential delays and damage; knowing who to call if there are changes to the plan may improve efficiency; and carriers can plan around expected contract volumes. These benefits do not arise when using spot capacity.

Before getting into the details further, it is important discuss the factors that need to be considered before deciding to opt for an alternative contracting mechanism.

Strategic Consideration

Market cycle timing

One of the most critical aspects of pricing is going to be where we are in the freight market cycle, when the price is set. Market prices may fluctuate considerably around an annual fixed-price contract, so it may become out of date fairly quickly. If prices are set as market prices increase, while shippers may celebrate locking in low prices, carriers will start rejecting freight over time. On the other hand, if market volumes are declining when prices are set, the shipper will be paying too much.

Contract age

As time passes from when the bid was made, we see that the amount of volume that is offered and accepted at the planned contract price degrades, as a result of market fluctuations, distribution network changes, or carrier performance level. Over time, shippers are relying more and more on prices that are not the originally set prices.

Regional attributes

Carriers have a higher willingness to offer capacity on major freight corridors with high volumes. This is because it is much easier to find backhauls and fill trucks with follow-on loads after dropping off a shipment.

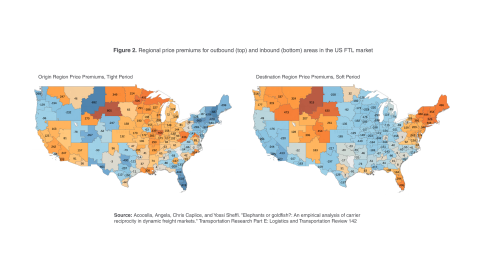

Geographic regions with low outbound volume (freight ‘sinks’) have lower outbound freight prices, because carriers need to relocate equipment out of these areas. In Figure 2, I show relative outbound (top) and inbound (bottom) regional price premium values for FTL contract prices in the US.

We can look at Florida and the New England regions as examples. Neither area produces much FTL volume. Carriers are willing to accept lower prices outbound from these regions rather than getting stuck and having to move empty containers, to reposition their equipment. As another example, using the Port of Los Angeles and Long Beach on the south-western coast as a freight ‘source’, it is considerably less expensive to ship into this region, because high import volumes lead to opportunities for carriers to easily find a return shipment out.

A similar scenario can be observed in Europe, as Francisco Suris, Business Development Management at Transporeon, highlighted in our third masterclass. The United Kingdom and Scandinavia are clear examples where there's a great imbalance, in terms of trucks versus loads. In the United Kingdom, only 1 out of 5 trucks get a load back into continental Europe, according to data sources. In Eastern Europe on the other hand, where there's a high density of carriers, west-to-east loads are very attractive.

Dynamic pricing: index-based contracts

As we discussed in the previous masterclass on lane segmentation, the network segments where fixed-price contracts have poor carrier performance, are good candidates for dynamic pricing. These include lanes with inconsistent demand. where shippers can end up paying $100-200 more per shipment on lanes. At the individual shipment level, surge volume – volume that is above the expected or awarded contracted lane volume – is an opportunity for alternative pricing. Especially for capacity-constrained carriers, these shipments end up rejected and on the spot market, much more frequently than the awarded volume.

To explore the potential benefits of index-based contracts, the goal is to design a contract which ensures:

- The shipper’s expected costs are no more than they would be with a fixed-price contract.

- The carrier’s likelihood of accepting shipments is at least as high as with the fixed-price contract.

- The carrier’s received revenue is at least as much with the fixed-price contract.

Importantly, we want a Pareto improvement – that is, where at least one of these is improved, and none are reduced.

Using a large industry dataset and a set of machine learning techniques, we developed a model of carrier freight acceptance decisions that predicts the likelihood a carrier will accept a shipment. This is based on its price, relative to the current market prices and lane regional attractiveness, the type of shipment, the carrier, and demand pattern characteristics.

With this model in hand, we ran a set of simulations over years of demand data to determine which designs and networks segments can achieve this Pareto improvement of the index-based contract, over the baseline fixed-price contract – and how much of an improvement we might see.

We found that in tight market conditions, when spot market prices are high, fixed-price contracts often become obsolete, and we see carriers providing capacity to the spot market more often. For high and moderate demand volatility lanes, and low frequency or cadence lanes, we can observe a 1-5% lower expected cost for the shipper, 2-4% higher acceptance probability from the carrier, and 1-9% higher expected revenue for the carriers. Multiply these numbers by the millions of dollars in spend, or the hundreds of thousands of shipments each year, these savings can become quite substantial.

Summary and takeaways

While there are many ways to utilise spot market data, there has been a major shift from using spot as a back-up, last resort option, to a strategic choice in a shipper’s portfolio of capacity options. Over the course of these three webinars, we’ve explored ways to think more strategically about the spot market. In this session, I demonstrate how dynamic pricing can be strategically incorporated into the contract portfolio mix and how there may be benefits for both shippers and carriers. However, implementation challenges remain. As such, Transportation Management Platform providers must work towards enabling dynamic, automatically changing prices and establishing trust between partners to stick to these contracts through market-to-market cycles and ensure both parties see the expected benefits.

Check the whole masterclass series and learn more science-based methods to improve your freight sourcing and transport assignment.

SCIENCE-BASED TRANSPORTATION

Navigating procurement and assignment decisions

Read our essential report written by Dr. Angela Acocella and gain actionable insights that help you identify and implement an effective portfolio mix of contract and spot capacity. Get ready to re-think your more procurement strategy.

TRANSPOREON HUBS