Ocean Market Trends Europe – East Asia, February 2023

2 M Alliance and Carrier Strategies

The key topic this month was the announcement that the 2M alliance between Maersk and MSC will dissolve in early 2025. This was not completely unexpected, given MSCs aggressive expansion strategy and a strong increase in independently operated services of both carriers during the pandemic. While there are no immediate consequences and it will be roughly a year until the first “pre-divorce” network restructurings, this move underlines how the world’s largest carriers are pursuing very different strategies:

- Maersk has not only confirmed it does not currently intends to join another alliance, it also plans to fully integrate its subsidiary brands, including the time-honoured Hamburg Süd and the groundbreaking Twill. This is one more step away from identifying as an ocean carrier toward being a global logistics company, which just happens to directly operate ocean ships, the same way FedEx operates its own planes.

- MSC in turn seems committed to continue following its long-term strategy of aggressive, often anti-cyclical, often second hand, investments into ships and a sales focus on large BCOs.

- French CMA-CGM is placing orders for additional methanol-ready ships (despite the market downturn) and is rumoured to eye another forwarder acquisition. Reactions by other carriers will surely follow.

Demand and Market Development

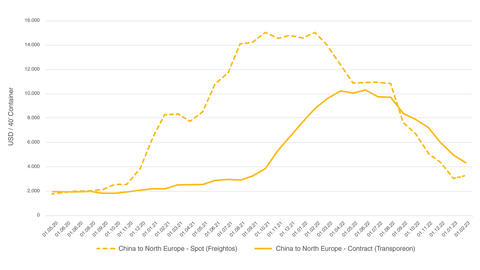

Macroeconomic indicators are showing better-than-expected signs of improvement. While the current economic slowdown may not turn into recession, inventory reductions are still ongoing and there is no cargo rebound currently on the horizon. Inflation and feeble demand are expected to keep volumes from China low over the coming months. As a result, contract rates to and from China continue to drop. Spot rates have somewhat stabilised due to high numbers of blank sailings before and after Chinese New Year. This has led to a further closing of the spot-contract rate gap, which on the China – Europe Trade might be history in one or two months.

Bottlenecks and Disruptions:

Declining cargo volumes from China to Europe and the US have eased port congestion, but temporary bottlenecks are still possible after the Chinese New Year.

In Portugal, port workers were on strike from 22nd of December till the end of January. Chances of more strike actions are increasing across the world as inflation is putting pressure on logistics workers’ disposable incomes.