Market observations:

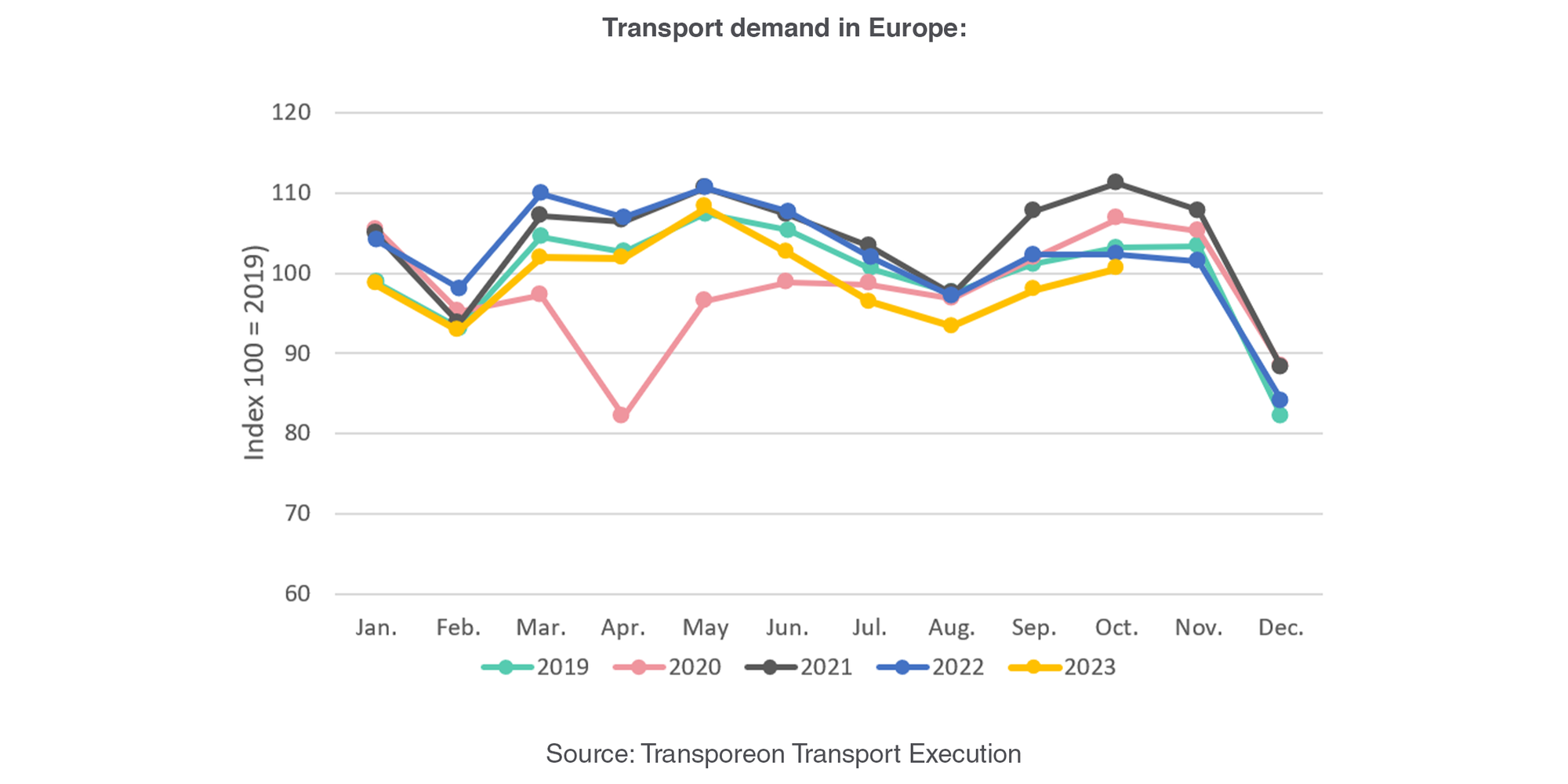

The European transport market is still strongly affected by the depressed economic situation, which directly impacts the demand for transportation services. In October, we observed a 1.8% decrease in demand, compared to the previous year. It's important to note that October 2022 was already affected by weakened economic conditions. However, at this moment, no conclusions can be drawn regarding a further decline in demand. This question is likely to be answered at the beginning of next year when figures for November and December are available. The construction and chemical industries are experiencing the most significant declines in demand for transportation services, with around 11% and 9% decreases, respectively, followed by the automotive and paper industries.

This lower demand for transport services is currently having a strong impact on available market capacity, which is ensuring a good availability of loading space, both in Europe and in Germany.

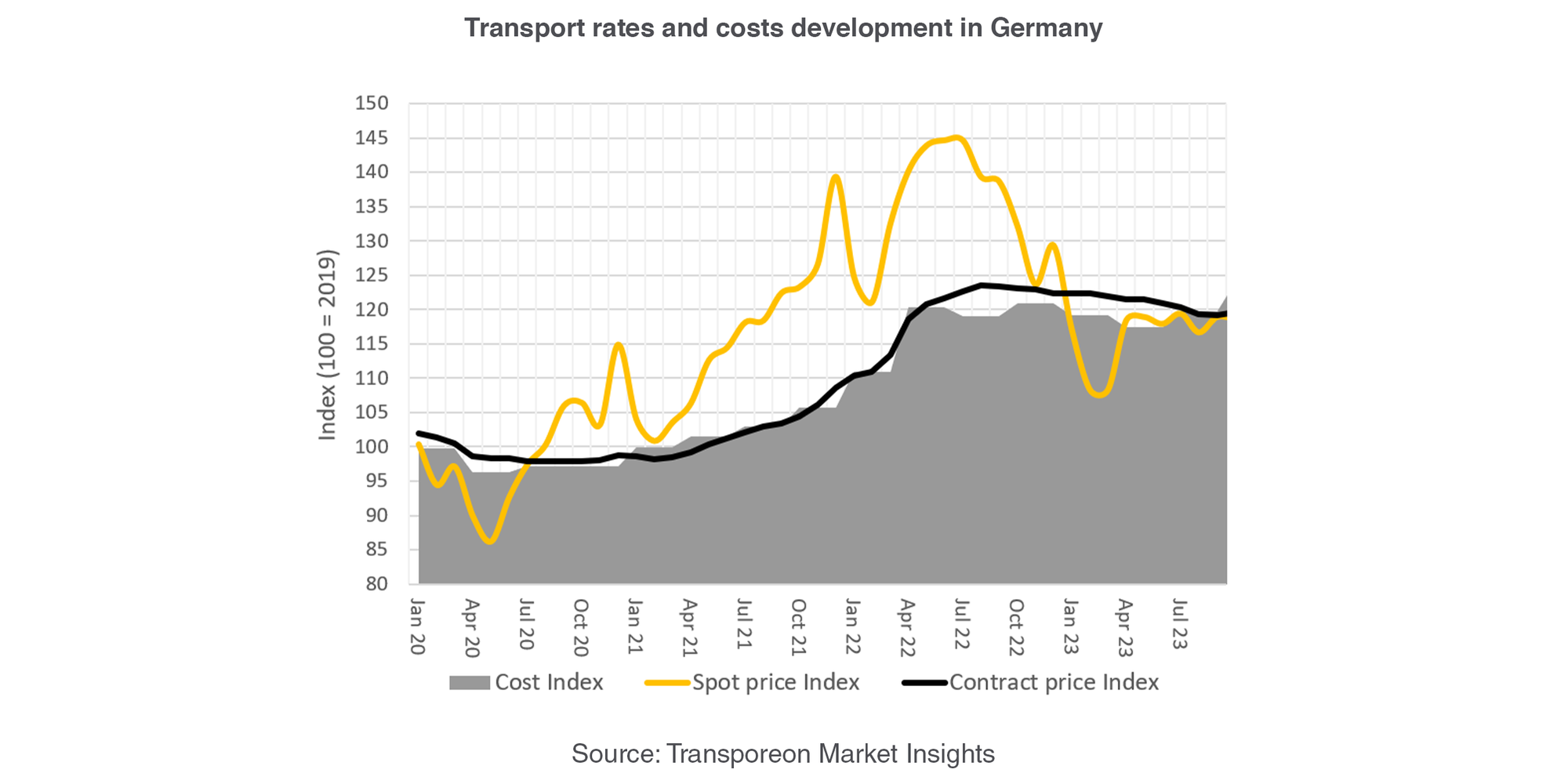

A look at the development of transport rates shows a predictable picture in relation to demand and capacity, with spot rates expected to fall sharply until March 2023. The last few months have been characterised by a seasonal trend at a lower level than in the last two years. On the other hand, contract rates rose to a new level in 2022 and have stabilised since then. Detailed analyses showed that cross-border freight rates fell much more sharply, while freight rates for domestic transport tended to follow the cost trends of transport service providers and remained stable.