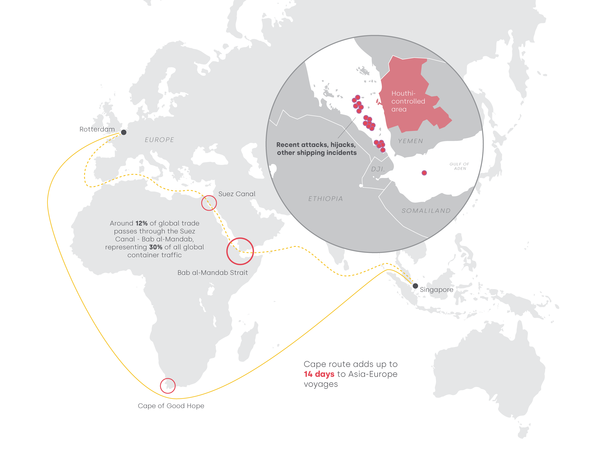

The UN trade body has warned that global trade is being disrupted by attacks in the Red Sea, the war in Ukraine, and low water levels in the Panama Canal. Shipping costs have surged and energy and food costs are being affected, raising inflation risks.

The freight rates for tankers bound for Europe have reached their highest level in almost four years due to increased turnaround times caused by the Red Sea crisis and the limited availability of LR1 and LR2 tankers. Rates for ocean container shipping are projected to exceed 6,500 per FEU between Asia and the Mediterranean by 2 February. Shipping companies are reorganising their services to accommodate the Good Hope route, and the situation is likely to lead to inflationary costs and higher travel budgets for jet fuel and diesel deliveries in Europe.

Air freight rates have increased for the first time in seven weeks due to the upcoming lunar new year in Asia and attacks on Red Sea shipping. The Baltic Air Freight Index rose by 6.4% in the week leading up to Monday, reversing previous declines. According to data provider WorldACD, while demand continues to improve - having increased by 5% in the two weeks leading up to January 21 - airlines have also been busy adding aircraft back into service resulting in a 12% rise in capacity, meanwhile rates are down 22% at $2.35 per kg.

Electronics, chemicals, automotive, machinery and other engineering industries in Europe are the most vulnerable to trade disruptions as they rely heavily on imported components from Asia in their production network, leading to potential production halts, shipment delays, increased logistics costs, and a risk of economic slowdown. This will prompt companies to diversify supply chains and re-shore production to mitigate risks.

European and US retailers are experiencing transport delays and increased costs due to disruptions in the Red Sea. Despite limited workarounds, retailers are choosing to absorb the higher transport costs rather than raising prices to maintain profitability. "Nearshoring" to source from local suppliers is being considered, but challenges such as cost and competition from China hinder widespread implementation.

Houthi attacks on shipping in the Red Sea are causing significant disruptions to the fruit and vegetable trade, leading to delays of up to three weeks and a fivefold increase in container costs. Southern European exporters, such as Italy, Greece, and Cyprus, are particularly affected, struggling to meet foreign market demands for perishable goods. There are concerns about a potential dumping of thwarted exports on the EU market, and the overall impact on global supply chains is causing instability and uncertainty.

Some Asian steelmakers are withdrawing from the European market or changing their shipping arrangements by shifting to FOB offers and leaving steel buyers to make their own transport arrangements, while other offers exclude the payment of duties. The crisis, combined with the implementation of carbon emissions reporting regulations, is expected to consolidate higher prices offered by European mills and could have a longer-term impact on the European economy by severely reducing the appeal and availability of steel imports.

The price of chemicals in Asia, particularly butanol, ethylene glycol, and butadiene, has risen significantly. The crisis has primarily impacted Southeast Asia and India, while China's PP prices are expected to be less affected due to abundant supply.

The Italian Federation of Road Transport (FAI) is urging the EU to intervene and request Austria to remove restrictions on lorry traffic through the Brenner Pass. This would establish quicker freight routes from Italian ports to European destinations. The crisis in the Red Sea has prompted this call for action.