Instant and secure payment

Liquidity is an important requirement for every transport service provider. With Instant Pay, you benefit from fast and direct payment after performance and direct, positive cash flow.

Flexible use

Do you need cash flow due to an urgent investment? You have salaries to pay, or repairs are due? Transporeon's Instant Pay offers you maximum flexibility. You can determine which individual transports need factoring and the service can be called up at any time, completely on-demand.

Stress-free and straightforward

Hand over your receivables directly to Instant Pay and avoid problems with late payments. Get paid directly and save yourself the stress of unpaid invoices or reminders.

100% Confidential

Our factoring service guarantees full confidentiality. All processes run in the background and in direct and exclusive communication with you. Your debtors are not involved in the service and continue to pay their invoices directly to you.

User-friendly and easy

The service is easy to use, fully digital and takes place via seamless integration. There is no need to upload invoices, documents, delivery receipts or similar. Your customer continues to receive the invoices from you, you receive the invoice amount from your customer in return and then pass it on to our Factoring partner.

Full integration in Transporeon Platform

Access to Instant Pay is very simple. After a one-time and successful registration with our factoring partner TeamFaktor NW GmbH, the service can simply be requested via the Transporeon platform in a familiar environment and with just a few clicks. The service is fully integrated and there is no need to switch to different platforms or tools. Benefit from usability because it is 100% digitally integrated into current and existing processes.

Facts and Figures

Most important functionalities

After successful, one-time registration with our Instant Pay partner TeamFaktor NW GmbH, you send your receivables directly from the system to the Instant Pay. You will receive payment of the factoring amount within a maximum of 48 hours. After payment of your invoice by the shipper, you simply pass it on to the Instant Pay company. Uncomplicated, fast and simple.

Fully digitalised onboarding process. After one-time registration, you can use the Instant Pay service completely within the Transporeon Platform.

Benefit from a clear dashboard with the most important KPIs such as the number of factored shipments, shipments with open factoring, outstanding enquiries, etc.

Intuitive user interface with quick and easy access to the Instant Pay service for single or multiple shipments.

Use Instant Pay flexibly and according to your needs, i.e. "on-demand", it's that simple. Our fee structure is transparent and fair and is based on the actual financing period. The receivable is paid out directly and without retention; you only pay a small surcharge. In addition, we do not charge any fixed costs.

After successful, one-time registration with our Instant Pay partner TeamFaktor NW GmbH, you send your receivables directly from the system to the Instant Pay. You will receive payment of the factoring amount within a maximum of 48 hours. After payment of your invoice by the shipper, you simply pass it on to the Instant Pay company. Uncomplicated, fast and simple.

Fully digitalised onboarding process. After one-time registration, you can use the Instant Pay service completely within the Transporeon Platform.

Benefit from a clear dashboard with the most important KPIs such as the number of factored shipments, shipments with open factoring, outstanding enquiries, etc.

Intuitive user interface with quick and easy access to the Instant Pay service for single or multiple shipments.

Use Instant Pay flexibly and according to your needs, i.e. "on-demand", it's that simple. Our fee structure is transparent and fair and is based on the actual financing period. The receivable is paid out directly and without retention; you only pay a small surcharge. In addition, we do not charge any fixed costs.

TRANSPOREON INSTANT PAY

Frequently asked questions

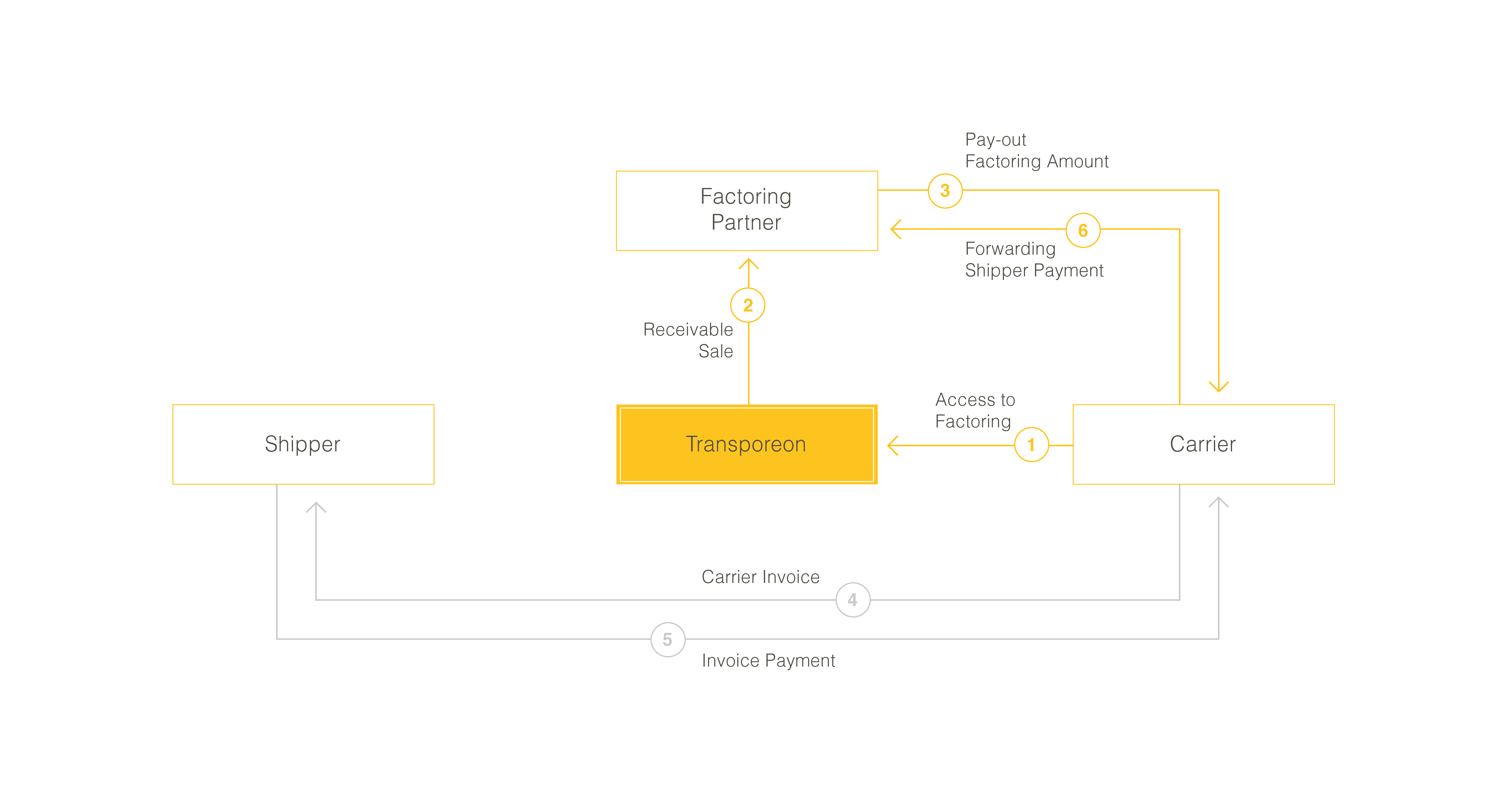

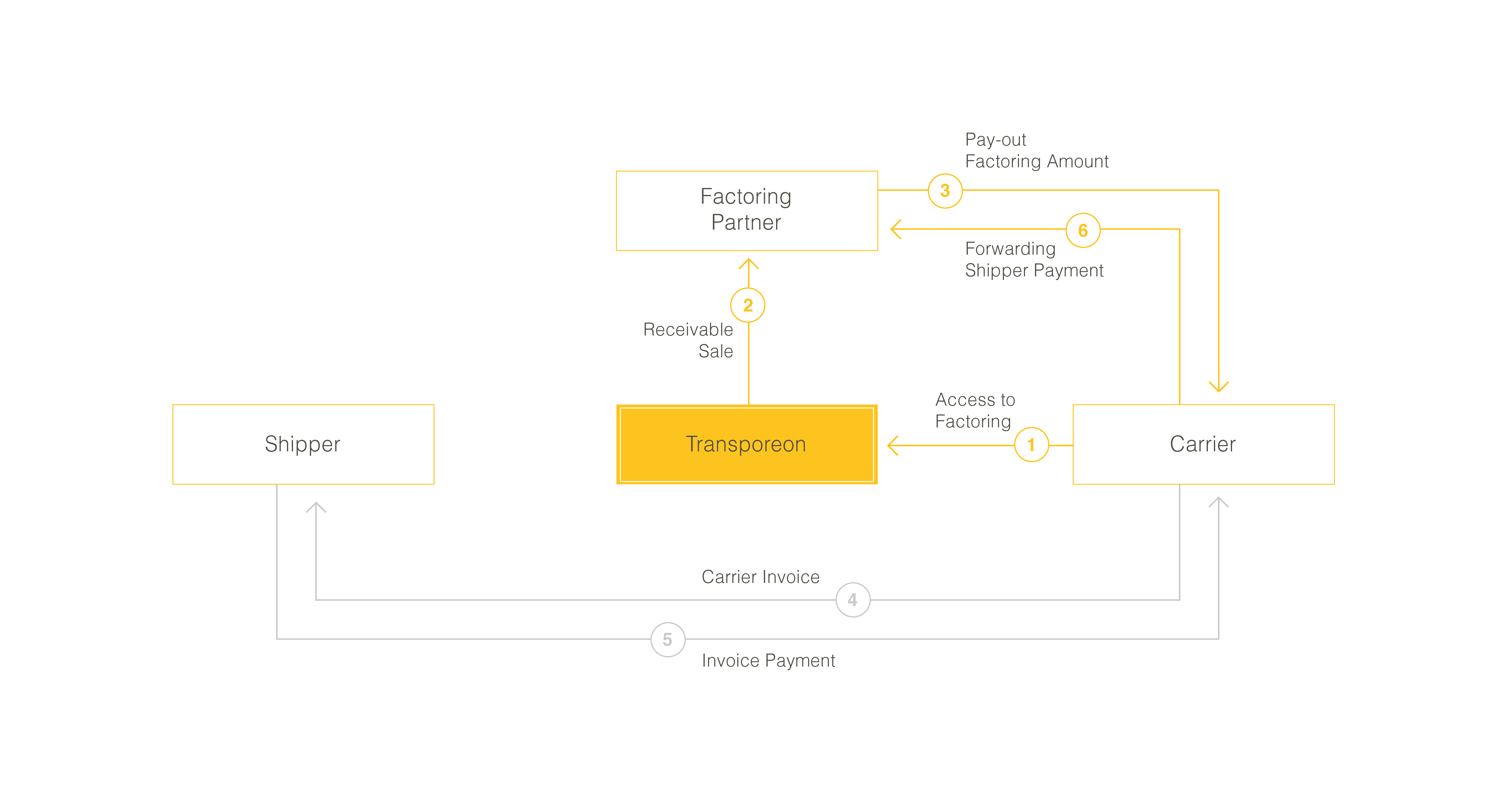

Transporeon Instant Pay supports carriers with their existing clients (shippers) by enabling them to sell delivery and service receivables to a factoring partner after a full service provision, thereby receiving the equivalent value of the receivable immediately before maturity. The claim transferred to the factoring partner can then be settled against the factoring partner after the carrier receives the related shipper payment following the due date agreed between the carrier and the shipper.

-

Log in to your Transporeon user account and go to the Instant Pay navigation entry. Here you’ll find a link to start the registration process. Please note that due to legal requirements, your identity must be verified by persons authorized to represent the company.

-

After successful registration you can use the Instant Pay application on the Transporeon platform. Simply select as many executed transports you want and send them to Instant Pay. Everything is done electronically on the Transporeon platform – you do not need to upload invoices or do other paperwork.

-

In case you can’t see the Instant Pay service yet on the Transporeon platform, please be patient as we are just rolling out the service step by step. You can reach out to us via EMAIL ADDRESS or TELEPHONE NUMBER in case you would like to participate in the early onboarding program and start using Instant Pay as soon as possible.

Transporeon’s Instant Pay product has special features that differentiate it from conventional market processes or competitive models. These special features are intended to make factoring services as easy as possible.

The most important features of Transporeon Instant Pay are:

-

Easy digital access with immediate confirmation of acceptance and without further obligations for the carrier (full digital rollout planned for December 2022)

-

Sale of receivables by the carrier based on the executed transports directly from the TP platform – and without the need of first processing and uploading invoices to the shipper

-

Implementation of a "silent procedure" without involving the shipper in the process flow or a declaration to the shipper with exclusive payment flow via the carrier bank account

-

Clear, transparent fee structures depending on the financing period without fixed amounts as well as direct payment of the full receivable amounts to the carrier without withholdings (minus the factoring fee)

TeamFaktor NW GmbH is Transporeon’s solution partner. The carrier will close a factoring frame contract with TeamFaktor during the course of the registration process as a prerequisite for activating the factoring product on the Transporeon platform.

- Factoring services will be offered and all open factored claims will be combined.

- Additional claims can be factored when the difference between the line and the sum of all open factored claims is larger or equal to the additional claim to be factored.

- Repayments, due or early, reduce the amount of open factored claims, allowing for more and/or larger additional claims to be factored.

- The line cannot be used to factor claims originating outside of the Transporeon platform.

You can select any transport for factoring that is shown as factoring-eligible in the factoring transport list. You can select one or many transports for one factoring request sent to the factoring partner. Every transport will be processed separately, independent from the grouping of the factoring requests.

The cost of a transport order will be proposed as receivable value for a factoring request so long as it is available on the Transporeon platform. You can modify/adjust the receivable value within the process of sending a request (dialogue provided for that). You can also set a transport price if nothing is registered on the platform. Please note that only net values (without VAT) can be used for factoring at this stage.

As of now, you can only use factoring services if your company is registered a Germany entity on the Transporeon platform (further countries to follow in 2023).

Receivable values must be in Euro (further currencies to follow in 2023).

You might not be able to use factoring services for receivables to shippers that are located in a country outside of the product scope.

You will receive one payout per day for all accepted factoring requests of the preceding day. Depending on bank processing times, you will receive the payout between one and three business days after sending the request.

In such cases, the carrier may provide the value manually as a basis for factoring such claims.

The factoring duration corresponds to the agreed payment terms with the shipper and can be between 30 and 90 days.

You must declare the payment term agreed on with the shipper within the process of sending a factoring request (dialogue provided for this). You can select payment terms between 30 and 90 days with 15-days intervals. If the agreed payment term is not available, you will have to choose the closest available one.

For any order, surcharges may be included as part of the factored claim, within defined limitations.

The carrier will cover the costs of the factoring service and will receive the claim amount minus the factoring fee.

-

All factored claims will be repaid by the carrier after the due date when the carrier has received the related payment from the shipper. Repayment will be done automatically via direct debit by the factoring partner after prenotification (approx. 5 days prior to debit).

-

In case of late or non-payment by the shipper, the carrier will be offered an option to delay the repayment until the Shipper’s payment is received. In such cases, the carrier is obliged to run a usual payment reminder process towards the shipper to ensure timely payment.

The factoring fee and the line volume will be decided based on a financial assessment of the carrier. Approval of a carrier is subject to a risk-based evaluation process and may result in a negative decision. The risk decision is based on credit bureau reports together with other data sources and may also include data describing the transaction history of the carrier on the Transporeon platform. The use of factoring services is limited to a credit line granted for each carrier. The credit line is calculated based on the full yearly turnover of the carrier declared within the registration process. The credit line may be changed over time or on demand of the carrier after individual approval by the factoring partner.

Every factoring claim will be included on a daily billing report. These reports should be used to reconcile with carriers’ books. Billing reports as well as other accounting-relevant documents are available on the factoring partner’s portal that can be accessed via the Transporeon platform.

PRODUCTS

Complementary solutions and products

Take a look at other solutions that support you in the efficient handling of logistical processes.

Learn more about Transporeon Instant Pay now!

Fill out the form below to request a demo for Transporeon Instant Pay or to learn more from one of our experts: