Ocean Market Trends Europe – East Asia, March 2023

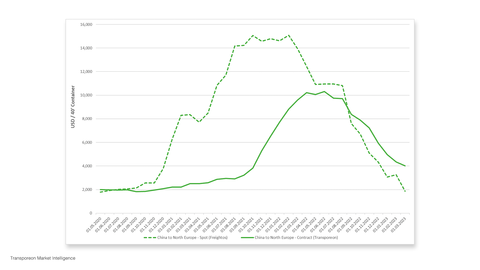

On the container freight market, Ex-China spot rates failed to recover after Chinese New Year, indicating inventory reductions are still not complete and demand continues to remain weak.

Likewise, recent statistics show that the seasonal drop of Europe to North America container volumes was more pronounced than in previous years.

Contract rates on most long haul trades continue their decline toward the spot rate level, closing the gap that opened after the spot rate decrease in the second half of 2022.

With this normalization of rates at or moderately above pre-COVID levels, tendering and contracting activities are also returning to established patterns.

Shippers that delayed tenders waiting for rates to fall are now increasingly going to the market to take advantage of the low Ex-Asia freight rates. Forwarder customers, pushed into quarterly agreements during COVID volatility, are able to transition back to yearly contracts.

Meanwhile multiyear agreements signed at elevated 2021 and 2022 rate levels are causing some tensions between shippers and carriers, as some shippers push for reductions.

Operational conditions are also improving, particularly after the Chinese New Year blank sailings set- backs. US East Coast ports and Inland Terminals are still experiencing some congestion, but waiting times are reportedly now less than one week.

A grab bag of smaller news items offers a glimpse at ongoing strategic repositioning underway by carriers:

- Maersk intends to sell off some non-core activities, including its container manufacturing and training division, underlining the shift away from a shipping-centered business model

- Maersk rival MSC has received its largest ship so far and also made a string of fresh second-hand vessel purchases, boosting their regional capabilities

- NYK (part of ONE) is selling its air cargo activities

- HMM’s state backed owners have announced intentions to sell their shares, returning the company to private ownership, but also flagging it as a potential takeover candidate